Construction Adds Just 10,000 Jobs in November, Still Outpaces U.S. Economy

The construction industry added 10,000 jobs on net in November, according to an analysis of data released by the U.S. Bureau of Labor Statistics.

|

| Construction sector employment rose by 10,000 jobs in November with moderate increases in both residential and nonresidential jobs, according to an analysis of new government data. |

|

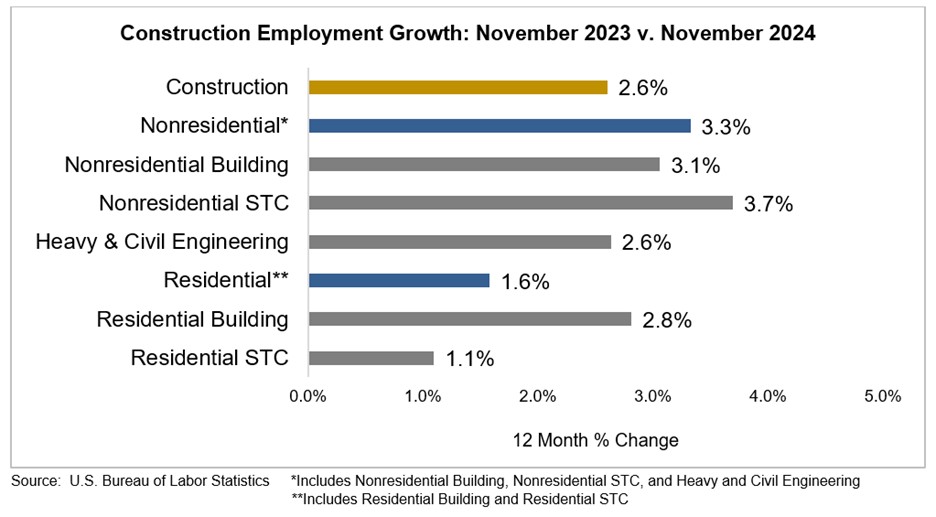

On a year-over-year basis, industry employment has risen by 211,000 jobs, an increase of 2.6%, nearly double the 1.4% gain in total nonfarm employment. Meanwhile, the average hourly wage for production and nonsupervisory employees in construction rose to $36.22, topping the private-sector average by 18.5 percent.

Economists from both the Associated General Contractors of America and the Associated Builders and Contractors appear to agree that contractors continuing to hire amid softening demand could be a sign that they expect a rebound soon.

“Job gains in both homebuilding and nonresidential building construction have slowed over the past year,” said Ken Simonson, the AGC’s chief economist. “But contractors have been hanging onto workers, a sign that they expect work to pick up soon.”

Simonson noted that a separate government report this week showed that construction industry layoffs in October fell to 97,000, the lowest monthly total in the 25-year history of the series. He said this suggests contractors expect to need more workers soon despite the modest job growth in November.

ABC Chief Economist Anirban Basu added that while November only saw a 10,000 job increase, industrywide, the employment growth has far outpaced the broad economy over the past year.

“More importantly, economywide job gains rebounded in November, confirming October’s paltry job growth was indeed a result of hurricanes Helene and Milton,” he added.

The two economists seemed to agree with the idea that contractors expect a bump in demand amid promises of regulatory relief from the incoming Trump administration.

“Contractors are expecting less red tape and more construction activity with the new administration,” said Jeffrey D. Shoaf, AGC chief executive officer. “The good news is the president-elect already has the authority needed to speed reviews and boost construction demand and employment.”

For November, employment trends varied among construction segments. Nonresidential building contractors reduced headcount for the third month in a row in November, by 1,700. Conversely, homebuilders and other residential building contractors added 1,400 employees and employment at residential specialty contractors climbed by 1,700 jobs.

Nonresidential construction employment increased by 6,800 positions on the net, with growth in two of the three subcategories. Employment at heavy and civil engineering construction firms—companies building infrastructure and power projects—rose by 1,500 positions, while nonresidential building lost 1,700 jobs last month. Nonresidential specialty trade contractors added the most jobs on net, with employment increasing by 7,000 positions.

Over the past 12 months, employment at nonresidential contractors increased by 3.3 percent or 158,900, compared to a gain of 3.9 percent (179,800 jobs) in the previous 12 months. Residential construction employment rose by 1.6 percent (52,400 jobs) from November 2023 to last month, compared to an increase of 1.9 percent (61,900 jobs) in the previous 12 months.

The construction unemployment rate rose to 4.6% in November. Unemployment across all industries rose to 4.2% from 4.1% in October.

“The combination of relatively cool payroll employment growth over the past three months, combined with a slight uptick in the unemployment rate, increases the odds that the Federal Reserve will cut interest rates again at their December meeting,” said Basu.

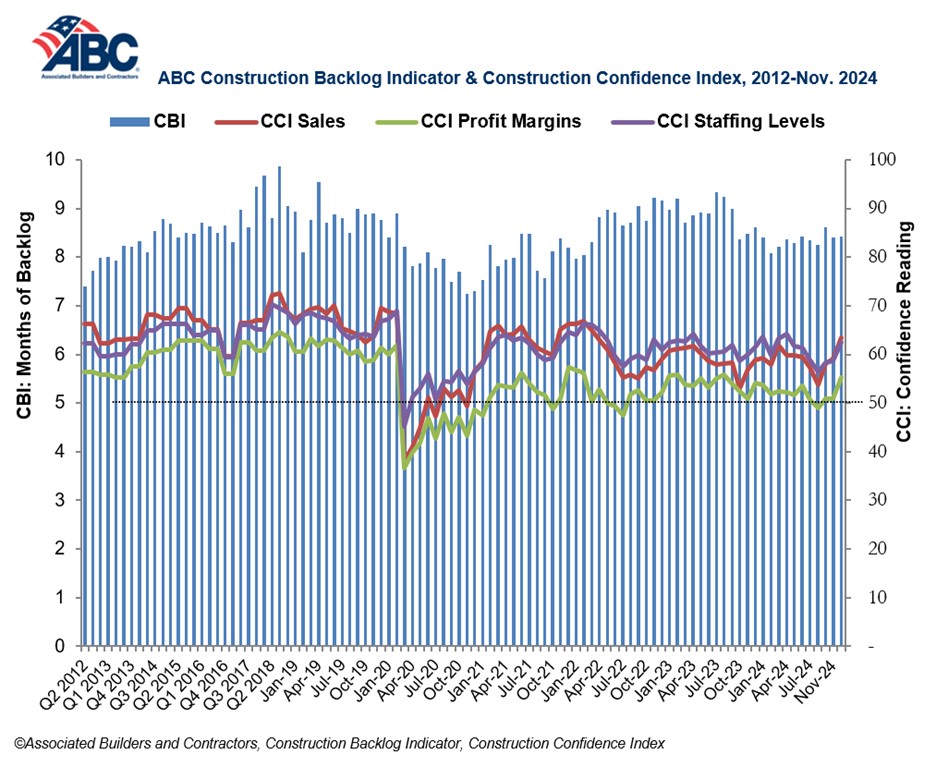

There appears to be plenty of reason for optimism in the construction industry given the prospect of lower interest rates. Per ABC’s Construction Confidence Index, contractor confidence surged in November despite backlog numbers remaining unchanged.

“This sudden improvement in confidence reflects increased policy certainty in the wake of November’s presidential election, and contractors are optimistic about the prospect of falling borrowing costs over the next several quarters,” Basu said. “Though backlog contracted in the commercial and institutional and heavy industry categories last month, contractors expect increased activity in privately financed segments during the next six months.”