Construction Industry Experts Uncertain on Tariff Impact

Opinions vary across industry associations and companies as to what impact the new tariffs announced by President Trump may have on the overall construction industry within the United States.

|

| Questions remain as to what sort of long term impact, if any, the new tariffs will have on the construction industry going forward. |

It depends on what role any business plays in the industry’s supply chain as a manufacturer, distributor, or contractor. However, most suppliers, builders, and economists seem to agree that at least in the short term, overall construction costs will rise.

“Employment within the construction sector grew at a steady clip in March, buoyed in large part by robust public-sector investments in construction activity,” said Jeffrey D. Shoaf, Associated General Contractors of America chief executive officer. "The real question is how the newly announced tariffs will impact the industry in the short and long term.”

Uncertainty was reportedly a common word used by exhibitors and attendees at the recent JLC Live Residential Construction Show in Providence, Rhode Island.

Conversely, in a prepared statement following the tariff annoucement, Wes Smith, president and CEO of the National Association of Electrical Distributors praised the president’s actions as being consistent with his longstanding concerns about trade imbalances and what he voiced about revitalizing domestic manufacturing during his campaign.

Smith noted that NAED recognizes that the actions will cause short-term uncertainty among members and supply partners.

“We remain optimistic about the broader policy agenda President Trump is advancing with Congress," he said, encouraging NAED members to remain flexible in the fluid environment as negotiations ensue and progress.

“Communication with suppliers is vital to managing inventory levels and pricing and in providing customers with the latest information to assist in sound business and investment decision making,” Smith said.

The varied statements were in response to President Trump’s unveiling of plans for a wide range of tariffs on numerous imported goods on April 2. Numerous key building materials were left exempt from the announcement, but that did not exempt the industry from potential impacts.

“While the complexity of these reciprocal tariffs makes it hard to estimate the overall impact on housing, they will undoubtedly raise some construction costs,” said Buddy Hughes, chairperson of the National Association of Home Builders (NAHB).

However, he also acknowledged that President Trump recognized the importance of critical construction inputs for housing and chose to continue current exemptions for Canadian and Mexican products, with a specific exemption for lumber from any new tariffs at this time.

Both countries are lead trade partners in lumber and drywall components specifically. Currently, Canada accounts for approximately 85% of all U.S. softwood lumber imports and nearly a quarter of the available supply in the U.S. As of now, the Canadian lumber tariff rates remainat 14.5%, however, NAHB officials expect this rate will increase later in 2025.

Further exempting Mexican products was also a big win for NAHB, given major construction cost drivers such as gypsum, concrete, and near-shored appliances. In additoin, no further increases were announced for steel or aluminum imports, which had already been set at a 25% duty.

Despite the repreive on some key materials,many industry experts continue to forecast overall construction cost increases that could further stress the industry due to the complexity of the tariffs and the potential impact across the entire supply chain line.

“NAHB will continue to work with the administration to find ways to increase domestic lumber production, reduce regulatory burdens, and create an environment that allows builders to increase our nation’s housing supply,” Hughes said.

The association estimates that approximately 7.3% of all goods used in new residential construction originated from a foreign nation in 2024. Costs for steel, aluminum, copper, home appliances, and other building materials sourced outside the U.S. are expected to rise because of the president’s global action on tariffs.

An industry survey completed prior to April 2 showed that builders were projecting housing prices to increase more than $9,000 per home based on tariffs.

The new tariffs are not only expected to raise the cost of building materials, which currently are up 34% since December 2020 but also lead to more challenges within the building material supply chain.

Hughes indicated that overall, it appears tariffs will reduce the availability of building materials and result in higher prices.

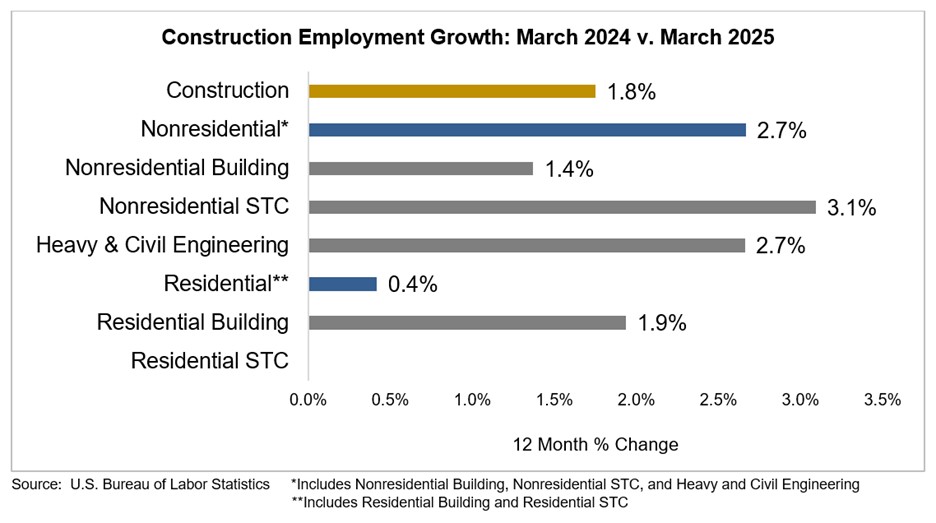

Employment up, or is it?

Despite concerns about the preliminary tariff announcements earlier this year, employment within the construction industry showed some improvement in March, with an increase of 13,000 jobs. However, on a year-over-year basis, the headcount has risen by only 1.8% or 143,000 jobs.

|

Also, the construction unemployment rate decreased to 5.4% in March and is unchanged from one year ago, suggesting contractors are holding on to current employees, even though other recent data shows a slowdown in hiring, job openings, and project spending.

Officials from both AGC and Associated Builders and Contractors cautioned that newly announced tariffs and potential retaliatory measures from U.S. trading partners have the potential to undermine future employment growth in the sector.

“Contractors added employees at a faster clip than other sectors in March, as pay for construction craft workers outpaced wages for production workers in the overall private sector,” said Ken Simonson, AGC chief economist. “However, as steep new tariffs and foreign countries’ retaliatory measures take effect, building costs will rise and projects will be put on hold, posing a threat to employment.”

Nonresidential construction employment increased by 22,300 positions on the net in March, with growth in 2 of the 3 subsegments. Nonresidential specialty trade added the most jobs, with a monthly increase of 19,300 positions, while heavy and civil engineering added 3,400 jobs, offsetting the dip of 400 workers within the non-residential building sector.

Residential construction employment declined by 9,800, as homebuilders and other residential building construction firms added 3,100 positions but residential specialty trade contractors shed 12,900 workers.

“At first glance, this is a perfectly fine jobs report for the construction industry,” said Anirban Basu, ABC chief economist. However, he said the details give some cause for concern.

“With downward revisions to the January and February numbers, the industry added just 8,000 jobs per month during the first quarter of 2025,” Basu said. “Construction employment is up just 1.8% since March 2024, the slowest year-over-year growth in four years.”

Officials from both associations indicated that new tariffs on virtually every country announced on April 2 are likely to undermine demand for construction in the short term as developers and public officials evaluate whether to proceed with planned projects amid rising materials prices and construction costs.

"March's labor market data is a lesser concern in light of the sweeping tariffs announced on April 2," Basu said. "What amounts to the largest tax hike since 1968 will reduce construction activity due to rising input costs, shaken business confidence, and potentially higher-for-longer interest rates. While contractors were sanguine about the outlook as of last month, industry expectations are likely to worsen in the coming months."