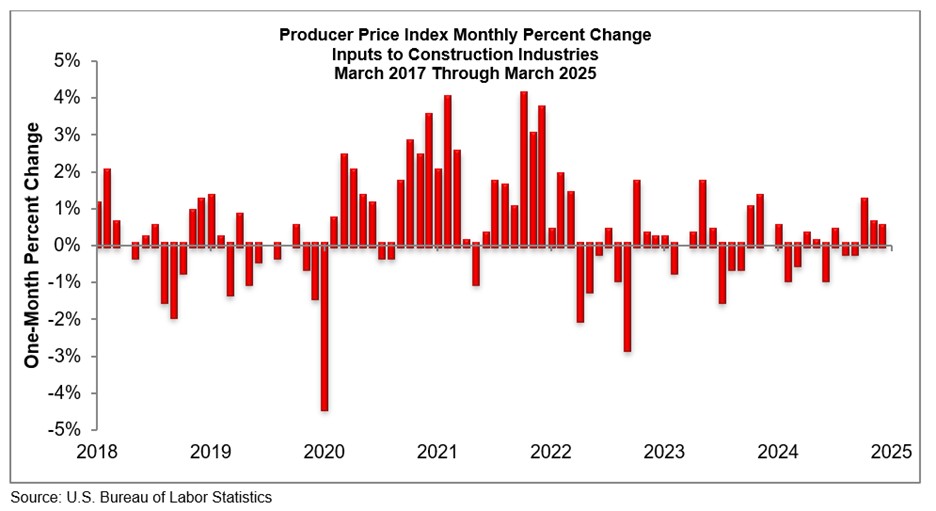

Tariffs Drive Surge in March Construction Prices

The price of construction materials and services used in non-residential construction rose 0.4% in March, the third consecutive monthly increase.

|

Analysis by both the Associated Builders and Contractors and the Associated General Contractors of America found that the flurry of tariff-related announcements in recent weeks has been contributing to a series of announced price hikes from a range of materials suppliers.

Both overall and non-residential construction input prices are 0.8% higher than one year ago. While crude petroleum prices fell considerably in March, that decline was more than offset by rapidly rising natural gas, steel, copper and lumber prices.

“Lumber and metals prices shot up in March, while contractors’ inboxes are bulging with ‘Dear Valued Customer’ letters announcing further increases for many products,” said Ken Simonson, AGC’s chief economist. “Rapid-fire changes in tariffs threaten to drive prices higher for many essential construction goods.”

The producer price index for inputs to new nonresidential construction—a weighted average of all materials and certain services used in new construction—rose by 0.4% in March, following increases of 0.6% in February and 0.8% in January.

It marked the first time since September 2023 that input prices had risen for three consecutive months. According to Simonson, the three-month increase followed a year of stable or declining prices.

“Construction input prices increased at a rapid pace for the third consecutive month in March and have now risen at a 9.7% annualized rate through the first quarter of 2025,” added Anirban Basu, ABC chief economist. “The emerging effects of tariffs are glaring in the March data release, with iron and steel, steel mill products and copper wire and cable prices all rising more than 5% for the month.”

Metals and lumber prices were the major contributors to the increase in March. The index for steel mill products soared 7.1% in March. Aluminum mill shapes jumped 5.1% in price for the month and the index for lumber and plywood rose 2.7%.

Simonson noted that prices used to calculate the indexes were collected around March 11,

Since then, the administration has imposed new tariffs of 25 % on steel and aluminum imports, 25% on many goods from Mexico and Canada, 145% on imports from China, and 10% on most other countries. A

Additional tariffs on copper and lumber are under review and much higher tariffs on many countries were imposed on April 9 but then suspended for 90 days.

“While contractors remain busy for the time being, this pace of input price escalation, coupled with rising uncertainty, will cause projects to be delayed and canceled if it persists for any meaningful length of time,” Basu said.

Officials from both associations noted that the new and planned tariffs will not only increase costs for many construction materials but are likely to lead to higher costs for many private and public sector construction projects.

AGC is urging the Trump administration to delay new tariffs until there is a greater market certainty about the impacts of those already put in place.

“Our members are trying to deliver the best value for the public and private sector clients they serve,” said Jeffrey Shoaf, the chief executive officer of the Associated General Contractors of America. “But it is hard to deliver that best value when you have no idea how much you are going to have to pay for many of the materials required to build projects.”