Construction Employment Growth Anemic in July

Construction employment edged higher by 2,000 jobs in July, as spending on projects underway in June decreased 0.4% from May.

|

Analysis of the federal data by economists from both the Associated Builders and Contractors and Associated General Contractors of America pointed to ongoing tariff and labor uncertainty as the reason projects are being delayed or scaled down.

“Employment growth in construction has slowed over the past year as uncertainty about tariffs and labor availability have caused owners to delay, stretch out, shrink, and cancel projects,” said, Ken Simonson, chief economist of the AGC. “As more structures that broke ground in past years reach completion, it is likely that industry employment growth will taper off even more.”

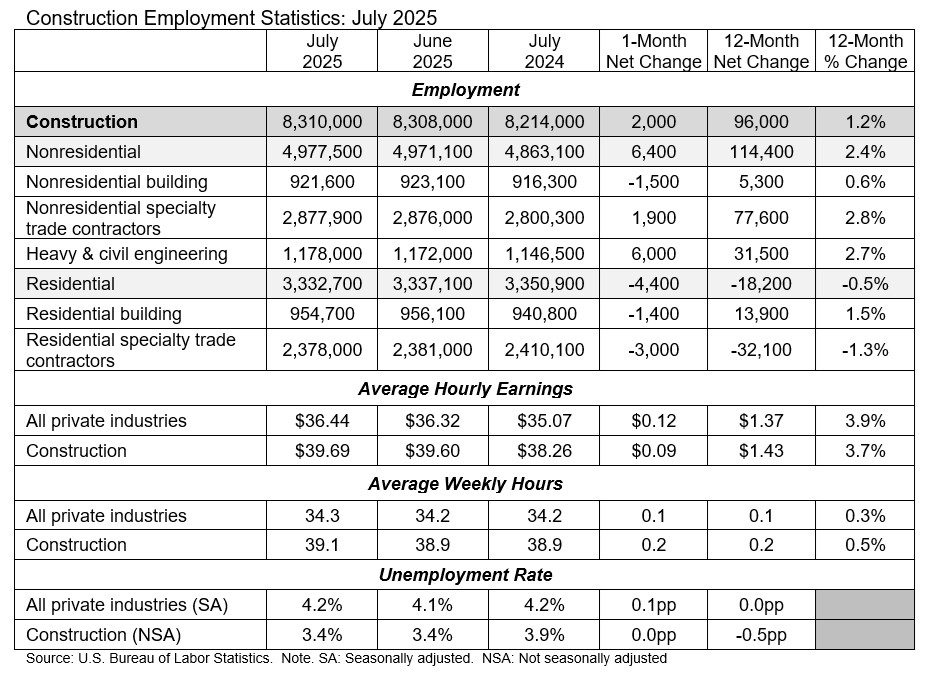

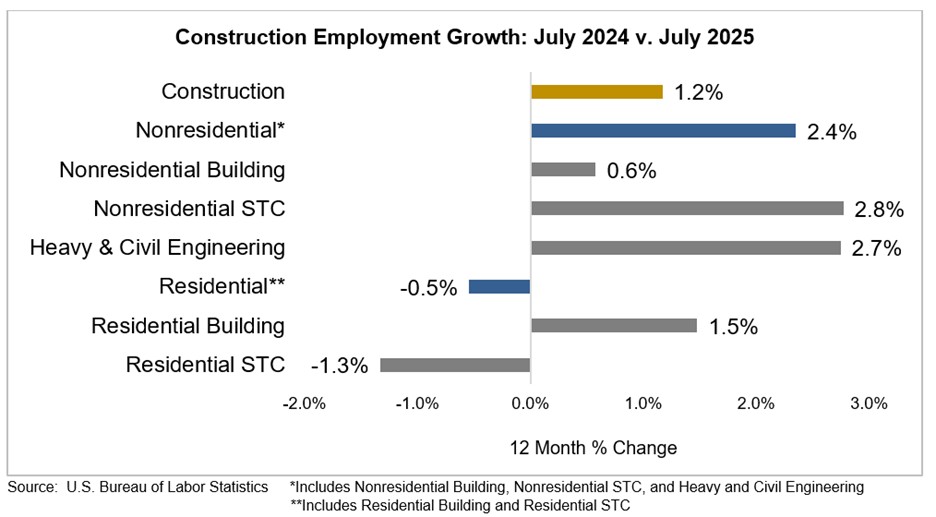

Overall construction employment totaled 8,310,000, seasonally adjusted, in July. On a year-over-year basis, industry employment increased by 96,000 jobs, or 1.2%. That gain is less than half as much as the increase of 200,000 jobs (3.1% percent) in the previous 12 months.

Nonresidential construction firms saw an increase of employment by 6,400 positions on net from June to July, with growth in 2 of the 3 subcategories. Per review of the federal reports, heavy and civil engineering added 6,000 jobs, while nonresidential specialty trade added 1,900 new positions.

In addition, nonresidential building reportedly lost 1,500 jobs for the month.

Over the last 12 months, nonresidential construction has increased by 2.4% or 114,400 jobs. That increase more than offset a decline of 4,400 employees for the month and 18,200 (-0.5%) over 12 months at homebuilders and residential specialty trade contractors.

The construction unemployment rate remained unchanged at 3.4% in July, while unemployment across all industries rose from 4.1% in June to 4.2% last month.

|

“The construction industry has added just 7,000 jobs over the past four months,” said Anirban Bas, ABC chief economist. “Industrywide employment is up only 1.2% over the past year, a lackluster pace of growth that historically is seen during and immediately following recessions.”

He said the good news for ABC members is that the nonresidential segment continues to outperform, growing at twice the pace of the industry at large over the past 12 months.

In conjunction with the reduced job growth, spending totaled $2.14 trillion at a seasonally adjusted annual rate in June. The total was 0.4% below the May rate and 2.9% lower than the June 2024 level.

The construction spending total was dragged down by decreases in private residential and nonresidential projects, which outweighed a small pickup in public work.

According to the associations’ analysis, private residential spending declined 0.7% in June and 6.2% over 12 months, while private nonresidential spending slipped by 0.3% for the month and 4.0% percent year-over-year.

Conversely, public construction outlays rose 0.1% from May to June and 5.2 percent over 12 months.

AGC officials urged the Trump administration to continue completing trade agreements to provide greater tariff certainty. In addition, they urged the administration to focus its immigration enforcement efforts on undocumented individuals who are engaged in additional criminal activity to avoid additional disruptions to construction and economic development projects.

“The more uncertainty there is, the less likely developers are going to invest in significant new construction projects,” said Jeffrey D. Shoaf, AGC chief executive officer. “The more this administration can do to provide economic certainty, the more likely demand for construction will rebound.”