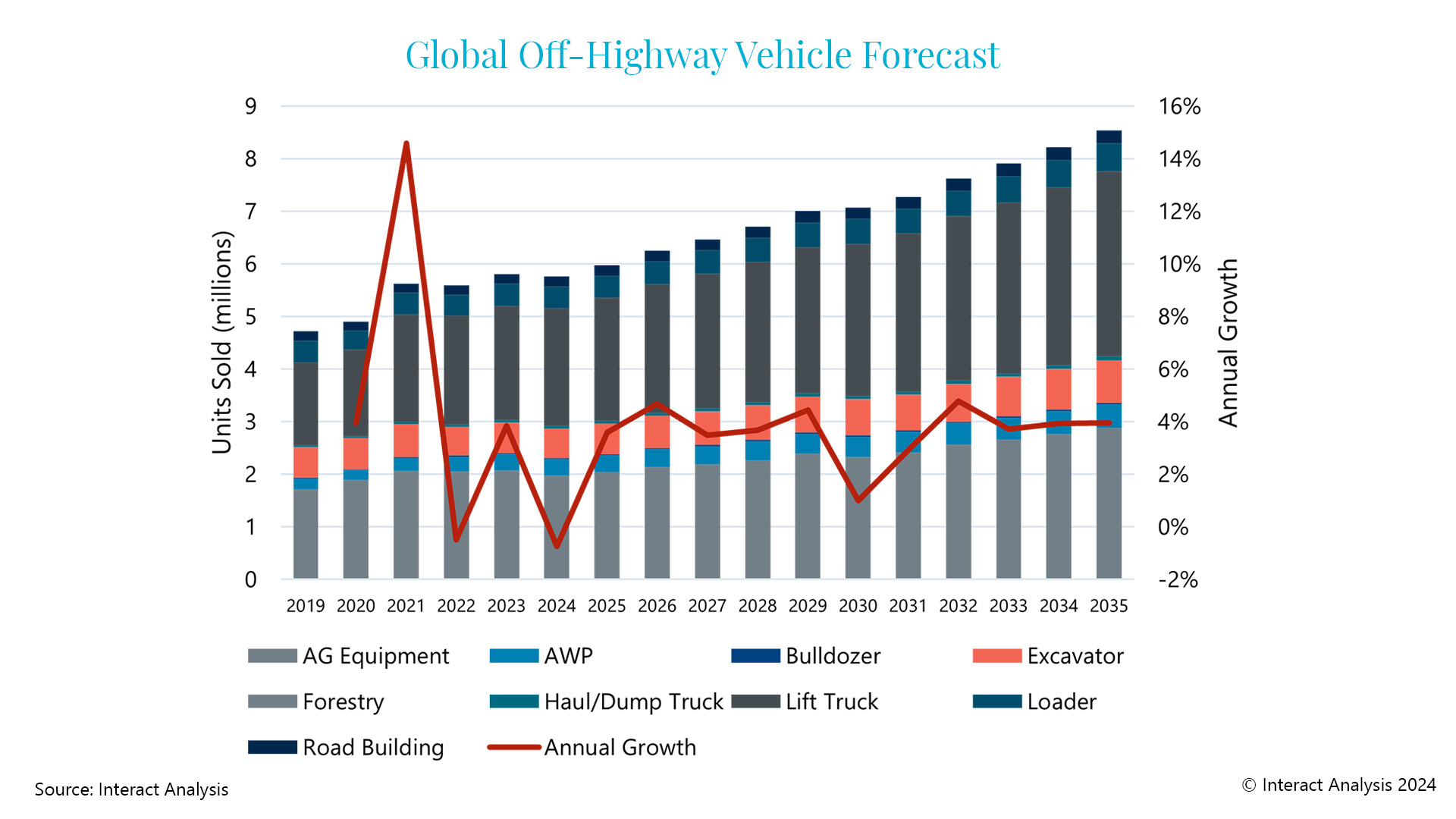

Group Sees Encouraging Signs for Global Off-Highway Market

Internal combustion engine sales (including hybrids) are forecast to continue growing out to 2035.

Following a turbulent few years, the global off-highway vehicle market is stabilizing

Global unit sales to contract slightly in 2024 but persistent long term growth is forecast

Growing mechanization in emerging economies is driving sales

There are encouraging signs for the global off-highway market in 2024 following a turbulent few years, as supply chain issues resolve themselves and the market appears to be returning to a more stable business cycle. The post-Covid boom is coming to an end and global unit sales are forecast to be smaller in 2024 than last year, but steady long-term growth is anticipated as increasing mechanization in emerging markets drives sales.

In many countries construction sales will slow for a range of different reasons, including high inflation and interest rates, which are curbing spending, housebuilding, and infrastructure development. Additionally, the post-Covid boom is waning and farmers are being impacted by poor weather and high energy costs, restricting their ability to purchase new equipment.

However, persistent, long-term growth is being seen in emerging economies as the rate of adoption of mechanization gathers momentum. India, South-East Asia and Brazil are expected to see wider adoption of machinery, driven by rising wages and demand to increase food output.

ICE to continue dominating the off-highway machine market in 2024

In terms of engine type, despite the increasing use of electrified machines, internal combustion engine (ICE) sales (including hybrids) are forecast to continue growing out to 2035, pushed up by low-power ICE machines in agriculture, construction and lift-trucks. The booming tractor market in India is expected to generate a surge in ICE machine sales in APAC, while sales in the Americas and EMEA regions are anticipated to remain steady.

Within the battery electric machinery market, sales will remain a relatively small proportion of overall global volumes, while demand this year will remain very low as lack of clear regulations and comparatively high upfront costs continue to constrain sales. This is with the exception of forklifts and aerial work platforms (AWPs), where penetration rates are already high. After 2030, battery electric sales volumes are forecast to accelerate, rising to 350,000 units sold annually by 2035, with high volumes expected in APAC and strong penetration rates in EMEA and the Americas.

Alastair Hayfield, Senior Research Director at Interact Analysis, says, “Lower power machinery will continue to dominate both ICE and battery electric sales in 2024. Most ICE engine sales will be in the sub-100 kW category, with 75% of those below 55 kW. Furthermore, machinery under 230 kW constitutes the overwhelming bulk of battery electric sales, and almost all battery electric machines sold are likely to be under 100 kW in power this year, reflecting the ongoing cost and technical challenges of electrifying larger machinery.

“Moving forward we expect the off-highway low-power/low margin engine market in APAC and the off-highway high-power/high margin engine markets in EMEA and North America to be hotly contested, particularly as sales of automotive and on-road commercials decline.”

About the Report:

The well respected Interact Analysis market report providing insight and analysis into the global off-highway vehicles industry.

About Interact Analysis

With over 200 years of combined experience, Interact Analysis is the market intelligence authority for global supply chain automation. Our research covers the entire automation value chain – from the technology used to automate factory production, through inventory storage and distribution channels, to the transportation of the finished goods. The world’s leading companies trust us to surface robust insights and opportunities for technology-driven growth. To learn more, visit www.InteractAnalysis.com