STAFDA Cash Flow Consultant: Trade Credit

A 21st Century Profit Source

|

|

In “Lean” thinking there is a line of thought that believes that: 1) All work occurring in an enterprise is interconnected; 2) Variation exists in all processes, and; 3) Understanding and reducing variation are keys to success/efficiency. I agree with #1 but as to #2 and #3, I would add some points of clarification.

To #2, I would add that variation is an ongoing given and thus new conditions and existing circumstances must drive new processes.

To #3, I’d add; understanding that every enterprise is different and unique is to understand that there is more than one path to the mountain top/efficiency, and it is the identification and elimination of contradicting beliefs, via new goals, that best contributes to new processes and new efficiencies.

A recent email from the CEO of a large regional distribution company reminded me of an article I wrote in 2001. First, here is that email, then the article, then my reply to the email and finally some thoughts about A 21st Century Profit Source . . . too often still waiting to happen.

THE EMAIL

“I am the CEO of a Fluid Power Distributors Association (FPDA) distributor. We do our due diligence up front on credit checks and over the past five years our A/R days averaged 42.

“Where there is sizable sales opportunity, our sales/inside sales employees are expected to start the qualification process before they quote a customer so they don’t waste time with someone who doesn’t/can’t pay their bills.

“We have very little write-off in a normal year and have been caught off guard by few significant bankruptcy filings over the years.

“Where we run into problems is with new or newer companies with little history or references. Ninety percent of our business is with small to medium size OEMs. Small start-up companies often offer us the most opportunity to move our products and expertise in the design and spec stages of building a new machine. These same new and newer companies carry greater risk.

“In your presentations you have stated that, on improving A/R you can be too restrictive with your credit policy and ultimately cost yourself business. We know this to be true — we recently lost approximately $150,000 worth of business at 30% GM (gross margin) for 2011 and $300,000 for 2012 because of our credit terms.

“Based on our credit check, our CFO required 1/3 down, 1/3 at delivery and 1/3 Net 30 Days due to a lack of credit history. On the initial order for $26,000, our competitor matched our pricing and took the business on Net 30 Day terms. I have a very unhappy salesman.

“Can you offer any thoughts or means for evaluating credit risk or alternatives we might have offered this customer when they balked at our terms? Are we missing any tools we could be using to help us achieve profitable growth with these small and new companies?”

Sure I can. Now, here is my article from 2001 addressing this issue.

THE ARTICLE: The Most Profitable Sale Waiting To Happen

It may seem like a contradiction, but there are times when more bad debt can mean an improvement to the bottom line.

The CEO of a $30M-a-year STAFDA house called me with this question. “Last year we wrote off $5,000 to bad debt. Do you think we’re too tight on credit approval?”

“First, let me ask you a couple of questions,” I said. “Do you have any unused capacity? Could you take on more business without having to hire any new people or take on any additional fixed expenses?”

The CEO answered “yes,” to both questions. Next I asked, “Are you currently turning down any credit sales? Are you rejecting riskier credit customers based on your terms?”

Again, the answer was “yes.” They had a long-established “risk” model based on TIB (time in business) and a customer’s payment history that they used in their credit qualification process. Based on this standard, they would judge new customers and decide whether or not to grant credit terms.

This pass/fail, black/white mindset about credit approval feeds on the use of DSO (days sales outstanding) and bad debt performance measurements and fails to factor-in the seller’s product value at the time of the sale.

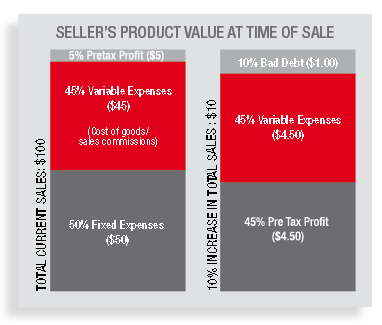

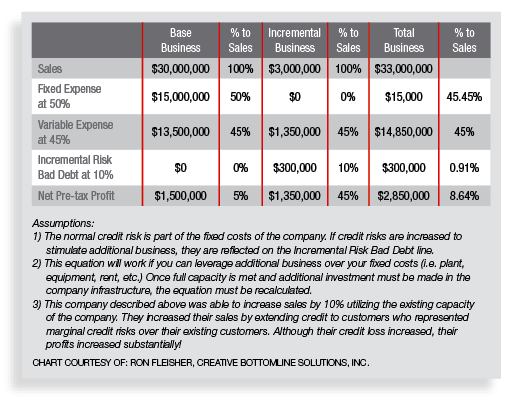

I then asked the CEO to draw a bar graph representing his total current sales, and — to keep things simple — to make the amount $100. Starting from the bottom, the first 5% or $5 was the pretax profit, the next 45% or $45 was variable expenses, such as cost of goods and sales commission.

The remaining 50% or $50 was the fixed expenses that do not fluctuate with changes in production activity level or sales such as rent, insurance, dues, equipment, loans, depreciation, fixed salaries and advertising.

Next, I asked him to draw another bar graph representing a 10% increase in sales via new and perhaps “riskier” customers who did not fit the company’s established risk model. Of these new sales, we would budget a whopping 10% for situations where the customers would fail to pay (bad debt loss).

Of the new sales, $1 would be lost and there would still be 45% or $4.50 in variable expenses but because of the existing unused capacity to take on more business, there would be no additional fixed expenses. The pretax profit on the riskier credit sales would then leap from 5% to 45%, a 900% improvement because of the effect of “seller’s product value at the time of sale.”

When approving credit sales to new customers, most companies do a pretty good job of weighing a customer’s profile; time in business, etc. They do a fair job of checking past credit history, but all too often they fail to take into consideration their product value at the time of the sale, which will vary based on the conditions and existing circumstances at that time.

Examples:

1. A distributor of ski hat pins and sunglasses was writing off 20% of all credit sales. The only requirement for credit terms was that the customer provide a name and street address for shipping —that was it. Any new customers with a post office address were rejected out of hand.

Most companies couldn’t survive for long with such high bad debt write offs, but this company was only paying 3 cents for a hat pin and selling them for $1, a markup of 3,333% and they had a minimum sale policy. You can still go to jail for selling most products with this kind of markup, depending on the product.

Their product value at the time of the sale was very, very low compared to the selling price. Just the opposite is true of products/services with a high cost and low markup, they have a high product value at the time of the sale; for example, a banker’s product — cash.

2. A trucking company had a truck going from Denver to Omaha; on the return leg it was coming back empty. What is the “product value” of a truck coming back empty from Omaha to Denver?

Keep in mind that there’s a reason why Denver is called The Mile High City and Omaha is not — it’s uphill from Omaha to Denver. The “product value?” Zero? It is less than zero! The “product value” is a negative, a minus — minus the driver’s pay, gas, insurance and maintenance.

Knowing this, the trucking company contacted a customer with a slow payment history who had been placed on credit hold by other trucking companies. By getting 25% down and extending 60-day terms on the balance, a load was found for the return leg. And if this customer failed to pay the balance? Is all bad debt bad? NO, It depends on the product value at the time of the sale.

Slow turning Inventory has a low “product value,” as do products with a short shelf life such as cut flowers. Before the airlines reduced the number of flights and aircraft in service, flights commonly had a percentage of empty, unsold seats that, once the door of the craft closed, had a negative product value. That’s why two people sitting next to each other could pay very different fares. Today, new conditions and existing circumstances have changed the product value and what we pay to fly.

Businesses with customers standing outside their door with money in hand and wanting to buy, have high demand and have a high “product value.” The same companies with little or no new traffic have low demand and low “product value.”

Fail to take into consideration “product value” at the time of sale and you may well be passing up some of your most profitable sales.

And what about the CEO doing $30M a year? I ran into him at the next STAFDA annual meeting and we grabbed lunch. His credit sales and A/R were up, as were his turntime on the A/R and bad debt losses (but nowhere close to 10%). His biggest obstacle in factoring in “product value” was his credit manager, who had always been told, “All bad debt is bad.”

Coming in the next issue: Abe’s answer. CS

©Copyright 1982-2008 A/R Management Group, Inc. All rights reserved:

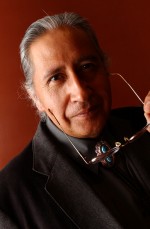

www.armg-usa.com. Abe WalkingBear Sanchez is the developer of the copyrighted Profit System of B2B Credit Management: a proven philosophy and set of methodologies that move the credit function from being a cost center to a profit-driven area of business. President of A/R Management Group,Inc. (www.armg-usa.com), Abe WalkingBear Sanchez is also a founding member of the international Profit Centered Credit Group.

www.profitcreditgroup.com.