FMI Construction Forecast 2011

The recovery is beginning — you just need a magnifier to see it.

By Phil Warner

If you heard last year at this time that the turnaround for the U.S. construction industry would start in 2010, you may have heard right, but you heard it too early. The recovery for construction will start in 2011, but most won’t really notice the change until 2012.

In fact, the recovery has already started, but it doesn’t show up in the traditional places like a rising line on the construction put in place chart or an announcement by the Bureau of Labor Statistics that construction companies are hiring again.

Where it shows up is in the signs that contractors have cut their staff down to just the best and most talented employees. Industry companies are focused on becoming leaner and more productive. They are ready for the recovery. Unfortunately, not all owners are ready to start new projects, but those owners that we call “serial builders” are well aware that they have never seen lower prices for construction than right now.

So, let the recovery begin, right? Not so fast, says the economy, or it would say that if it could speak for itself. We still have some unfinished business to clear up like the large problem with foreclosures. Bad loans and sloppy loaners have given good credit a bad name.

As banks try to unload their bad debt even faster than they took it on, it appears they have hired what has come to be known as “robo signers” processing documents even when they are on break or vacation. As it turns out, it isn’t that apparent who actually owns the mortgages that have been securitized and sold to you and me and everyone else around the globe.

How does this affect the next big box store or school to be built in your community? It means lower taxes on unoccupied homes, higher mortgage payments, so less money to spend on entertainment and new clothes. It means no new shopping malls or office space for the growing number of home workers, aka, the unemployed, and it means that the next bank is very reluctant to make a loan to the next person that walks in the door even if it is a thriving small business.

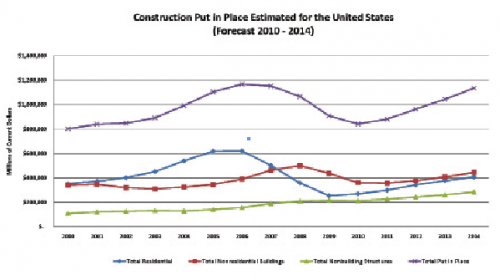

All this does not mean that construction will come to a halt. In fact, we expect a total of $881 billion in construction put in place in 2011, but that is about 25% less than the total for 2006.

The general economy is giving us mixed signs. GDP has been positive for four quarters, consumer confidence is up, inflation remains under control and businesses have begun spending. However, consumer spending has decreased from previous quarters, the recovery has been jobless so far, credit remains tight and the housing market remains at risk.

|

| FMI’s forecast for U.S. construction put in place through 2014 show nonresidential construction will be relatively flat until 2012. |

Total construction in 2010 will be down 7% after declining 15% in 2009. Residential construction is expected to begin recovering in 2010. Nonresidential construction will decline 18% in 2010 after declining 13% in 2009. An 18% increase in conservation and development construction will offset losses in nonbuilding construction.

In brief, The construction industry should prepare for another year of decline in nonresidential construction. Construction gained 19,000 jobs in August (of which 10,000 were due to the return of workers on strike in July). There have been losses in 34 out of 37 consecutive months, bringing the construction unemployment rate to 15.9%. That means there are 1.5 million construction workers out of work. An increase in residential construction in 2010 could begin to turn the employment situation, but it is unlikely that it would do much to offset the losses from nonresidential construction.

There are some bright spots in the midst of this slow recovery. Conservation and development construction is one of the few surprise winners from the stimulus bill. The Army Corps of Engineers received $4.6 billion from the stimulus.

However, not all of these funds will be used for what we consider construction. It will take several years for the funds to be worked into construction as it is a large amount of money, considering that the market was approximately $5.4 billion before the stimulus.

The Gulf oil spill will also contribute to the surging growth in this segment. The cleanup effort will contribute almost $500 million in 2010.

In addition, Sewage and waste disposal construction will remain at a historically high level. The market has more than doubled in size over the last decade from $10.1 billion in 1999 to $25.9 billion in 2010. Slow, steady growth will push the market to reach $30.5 billion in 2014.

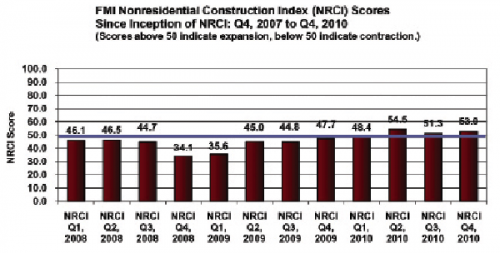

In addition to looking at the raw numbers, we also ask contractors their opinion of the construction economy and prospects. Of course, they look at the same economic reports as everyone, but they also know their own balance sheets and backlogs. For the fourth quarter, FMI Nonresidential Construction Index report, panelists confirm that things are improving but at a slow pace. The NRCI has been in positive territory for several quarters, but just barely so.

|

| Construction firm executives participating in FMI’s Nonresidential Construction Index indicate a slow improvement in 2010, but no distinct growth trend. |

When we asked construction executives that participate in the NRCI if the federal stimulus had helped them, most panelists working agreed that the results of the stimulus have been disappointing. Forty-four percent told us the stimulus has not helped construction, 29% thought it helped the industry but not their companies and 8% thought it may have hurt the construction industry.

Generally, this doesn’t bode well for another stimulus bill in the near future. Few expect it is a good idea to try another stimulus unless it is targeted toward specific infrastructure projects and not used to cover state deficits and other items that do not contribute to rebuilding aging infrastructure.

Our survey was conducted just before the elections, but panelists’ expectations seem to be in line with the majority vote. They do not expect another stimulus, no matter who controls Congress and especially not when the Republicans have the majority vote. When asked if they would like to see more stimulus, the results were mixed, but 27% thought the stimulus did not work very well, so why try it again?

One of the concerns expressed by many panelists was that passing the stimulus bill prevented Congress from passing a new transportation bill, a program that has seen success in the industry for many years now to help states build roads, bridges, runways and other vital transportation infrastructure.

The bottom line is that contractors are very aware of the need to rebuild the nation’s infrastructure, but as taxpayers, they do not want higher taxes and don’t know who will pay for it. The construction industry not only reflects the sentiments of the nation, they are leaner, more productive and ready to get back to work to build and rebuild the nation. CS

Phil Warner is a research consultant for FMI. He can be reached 919-785-9357; e-mail: Pwarner@fminet.com. Founded in 1953 by Dr. Emol A. Fails, FMI provides management consulting and investment banking for the worldwide construction industry. FMI serves builders; trade contractors; construction materials producers; manufacturers and suppliers of building materials and construction equipment; facility owners, managers and developers; engineers, architects; surety companies and industry trade associations. Learn more at www.fminet.com.