STAFDA Inventory Consultant: How Much is Free Freight Worth?

|

|

Placing a large order just to get free freight is not always your best choice. Here’s how to be sure.

Many vendors offer to pay freight charges if an order exceeds a certain minimum requirement. Many buyers are “brainwashed” into thinking that they must always place an order that meets the free freight minimum, even if it means bringing more inventory than can be used or sold in a reasonable amount of time. But is placing a free-freight order always a good idea?

In this article, we’re going to examine a process that will let you determine whether or not placing a free-freight order is a good buy. As you will see, sometimes you can maximize your profitability by paying the freight. Other times, placing a larger order just to meet the free freight requirement is not wise.

How much is free freight worth? That’s easy. It’s the dollar amount on the freight bill you would have paid had the vendor not covered this expense. You must consider “free freight” as an additional dollar discount offered by the vendor. Using the process described below, you can determine whether this discount exceeds the cost of

carrying the additional inventory necessary to meet the freight prepaid requirement during the time it takes to sell or use the entire shipment. Suppose you have a vendor who has a $500 minimum order, but offers free freight for a $2,500 order:

1) Determine the how much it costs (per dollar) for the vendor to send you a shipment. This can be done by dividing the total freight charges on the last five vendor shipments by the dollar amount for the merchandise on those shipments. If you do not have this information:

- A. Determine the total weight and/or cubic volume for each of the last five shipments from the vendor.

- B. Contact a freight company to find what the freight charges would have been for each shipment.

- C. Divide the total amount of the freight charges for these shipments by the total dollar amount for merchandise on those shipments.

2) A $2,500 pre-paid freight order offers a discount equal to 2500 times the average freight cost per dollar of material determined in step one. For example, if the freight cost was $.20 per dollar of material, a freight paid $2,500 order provides you with a discount of $500 ($2500 x $.20)

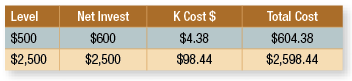

3) Add the cost of the freight you must pay for a minimum order to the cost of the material on that order. For example the minimum order the vendor will accept is $500. If freight costs $.20 per pound, you will have to pay an additional $100 in freight. So, you will pay $600 for $500 in material. For a prepaid order, you will pay $2,500 for $2,500 worth of material. That is, you won’t pay freight on the larger order.

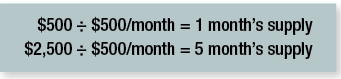

4) Calculate the month’s supply of the vendor’s products that each purchase amount represents. Assume that total demand for all of the stocked products in the vendor line is $500 per month:

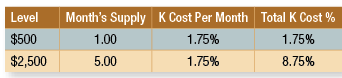

5) Calculate the inventory carrying cost (also known as the “K” cost) that would be experienced at each discount level. The carrying cost is the amount of money necessary to maintain the balance of a vendor shipment in your warehouse during the time it takes to sell the entire shipment. It is calculated using the inventory carrying cost percentage, a measurement that reflects how much it costs to maintain a dollar’s worth of stock inventory in your warehouse for an entire year.

You can receive a questionnaire for calculating your cost of carrying inventory on our Web site, www.EffectiveInventory.com. Just hit the “Carrying Cost” button on the left of the home page. The firm in this example has an annual inventory carrying cost of 21%. That is, it costs 21 cents to maintain a dollar’s worth of inventory in the warehouse for an entire year.

A. Multiply the net value of material purchased at each discount level by one-half. This is the average amount of the inventory purchased that will be on-hand during the time it takes to sell the entire shipment. For example, if it takes 20 days to sell the entire shipment, the average amount you will have on-hand is a 10-day supply. Half the time you’ll have more than a 10-day supply, half the time you’ll have less than a 10-day supply. Note that freight charges, which are part of the net investment, are not

considered in the average inventory investment!

B. Calculate the total inventory carrying cost for the time period you will have the shipment by dividing the annual carrying cost percentage by 12 (to

determine the holding cost per month), and then multiplying it by the month’s supply determined in step #4 above. The annual carrying cost for this example is 21%. Twenty-one percent divided by 12 is 1.75%.

C. Multiply the total carrying cost percentage from step “B” above by the average inventory investment that was calculated in step one. The result is your “carrying cost dollars” for the shipment. That is the total cost you will incur for maintaining this material during the time it takes to sell the entire shipment:

6) Your total cost of inventory (including all of the costs you will incur) is the net investment, plus the carrying cost dollars:

7) Finally, calculate the cost per dollar of inventory. The cost per dollar of inventory relates the total cost of inventory at each purchase level to the amount of inventory you will receive. This is calculated by dividing the total cost of inventory determined in step #6, by the stock dollars required for each purchase amount.

The cost per dollar for the $2,500 order is $1.04 or 16.3% lower than the level at which you have to pay freight. Even considering the cost of carrying the additional inventory, the freight savings realized with a $2,500 order make the larger purchase worthwhile. But, if the freight expense were less than $.20 per pound, it might not be a good idea to purchase a five month supply just to avoid freight costs. This analysis gives what was previously a very subjective decision, a definitive “dollars and cents” answer.

And keep in mind that you cannot place a $2,500 order every week. In order to reap the savings of the free-freight offer, you must place larger purchase orders, less frequently. If you place a $2,500 whenever you need one or two items, you will increase the amount of inventory in your warehouse.

It will take longer to sell this stock resulting in much higher carrying costs. It won’t take long for these carrying costs to exceed the discount provided by the free-freight offer, no

matter how costly the shipping charges.

So, if you plan to take advantage of free-freight offers, perform the analysis described above. And, only purchase these quantities when it’s time to place a normal target with the vendor. Plus, you’ll always know when your vendor is offering you a good deal! CS

Jon Schreibfeder is president of Effective Inventory Management, Inc. He has authored numerous articles and several books on inventory management best practices and is the designated inventory management consultant for STAFDA. Jon can be reached at 972-304-3325 or by e-mail at info@effectiveinventory.com