One Product Ranking is Not Enough

The 80/20 rule is elegant, but too simple for inventory ranking

Distributors often stock thousands of products. Properly managing the physical inventory and replenishment of these items is a challenging task. While most buyers and salespeople realize that not all items are equally important to customers or their company, it often difficult to identify those products that demand the most attention.

Distributors often stock thousands of products. Properly managing the physical inventory and replenishment of these items is a challenging task. While most buyers and salespeople realize that not all items are equally important to customers or their company, it often difficult to identify those products that demand the most attention.

About a hundred years ago, an Italian economist, Vilfredo Pareto, conducted some research on income distribution in Italy. He found that 80 percent of the income was earned by 20 percent of the people. You may find this interesting, but wonder at the same time, what does this have to do with separating your stock from your stuff? Well, other academics did some further research and found that in general, 80 percent of the results of any process are produced by 20 percent of the contributing factors. As a result the “80-20” rule was established. This tenet suggests that:

- 80 percent of your sales are generated by 20 percent of your salespeople

- 80 percent of your sales come from 20 percent of your customers

- 80 percent of your stock sales involve 20 percent of your inventory items

But this rule is not always true. In fact, we have found that for many companies, 80 percent of sales are generated by only 10 to 13 percent of stocked inventory items! Don’t assume that 20 percent of your stocked products account for 80 percent of your sales. Rank or classify your products based on their contribution to total sales.

But this rule is not always true. In fact, we have found that for many companies, 80 percent of sales are generated by only 10 to 13 percent of stocked inventory items! Don’t assume that 20 percent of your stocked products account for 80 percent of your sales. Rank or classify your products based on their contribution to total sales.

The products that account for 80 percent of your sales are typically referred to as “A” ranked items. This may be 5, 10 or 20 percent of your products. The items responsible for the remaining 20 percent of sales are often assigned ranks as follows:

- Items responsible for the next 15 percent of sales: “B”

- Items responsible for the next 4 percent of sales: “C”

- Items responsible for the last 1 percent of sales: “D”

- Items responsible for no sales: “X”

Many computer software packages rank products using this (or very similar) criteria. Unfortunately many of these systems only rank products based on the cost of goods sold from the sale of stock products during the previous twelve months or some other time period. That is, what you paid for the products you either sold to customers or were used to provide services to customers.

While this type of ranking is important to identify those products that have the most potential for inventory turnover (i.e., opportunities to earn a profit) it is not as valuable in answering other inventory-related questions such as:

- What products should be maintained in stock?

- Where should a specific inventory item be located in your warehouse?

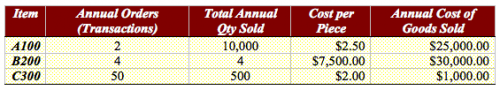

Consider the following three items:

Products A100 and B200 both have relatively high cost of goods sold, but these sales resulted from few transactions. Instead of maintaining these items in inventory could they be reclassified as special order products? A special order item is not maintained in stock inventory but ordered and received to fulfill a specific customer requirement.

Products A100 and B200 both have relatively high cost of goods sold, but these sales resulted from few transactions. Instead of maintaining these items in inventory could they be reclassified as special order products? A special order item is not maintained in stock inventory but ordered and received to fulfill a specific customer requirement.

On the other hand product C300 was sold 50 times in the past year. Though the annual cost of goods sold is low, customers requested the item about once a week. It is probably important to have this product in stock to maintain a high level of customer service.

When deciding what products to stock in a warehouse it is more important to know how often the product was requested by customers rather than the value of material moving through your warehouse. This is why it is important to rank by “hits” as well as cost of goods sold. A hit is an order or request for a product, regardless of the actual quantity ordered. Whether a customer orders one, ten or one thousand pieces on a single order it is considered one hit.

The more hits an item accumulates, the more reason you have to stock the product. Item C300 in the chart above might be a “C” ranked product based on cost of goods sold, but an “A” ranked product based on hits.

Hits ranking is also a good tool for determining where stocked products should be located in your warehouse. Products that are requested most by customers should be assigned to the most accessible bin locations.

Reorder quantities of a product with a high cost of goods sold ranking should be carefully determined to achieve a high level of inventory turnover. At the same time you might consider maintaining additional safety stock for products with a high hit rank to minimize the chance of stock outs.

You also might want to include a third type of ranking in your classification analysis, one based on profitability. Wouldn’t it be helpful to let salespeople and management know what products carry the highest gross or margin percentages or profit dollars?

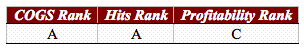

Categorizing each product utilizing all three ranks provides a comprehensive analysis that no single ranking can provide. For example, product A100 is assigned an “A” rank based on annual cost of goods sold. But a “three-way ranking” provides a more complete picture:

This is a product that is ordered frequently by customers and has a lot of dollars moving through inventory but does not generate a lot of profits. This may be a loss leader that should drive additional profitable sales.

Consider the three-way ranking of another product assigned an “A” rank based on annual cost of goods sold:![]()

This is a much more profitable item but it experiences fewer hits. You might ask your salespeople if anything can be done to encourage more sales of this product. What would the ranking of your “best” products look like? Well, consider the three-way ranking for the following item:

![]()

This is a highly profitable item that is sold quite often. But because it is low in cost, it does not require a high dollar investment.

Ranking products based only on annual cost of goods sold provides an incomplete picture of inventory performance. Three-way ranking provides valuable information concerning each stocked products contribution to the overall profitability of your organization; information that is vital in your quest to achieve effective inventory management. Ask your IT or computer support people about implementing this tool today. CS

Jon Schreibfeder is president of Effective Inventory Management, Inc. He has authored numerous articles and several books on inventory management best practices and is the designated inventory management consultant for STAFDA. Jon can be reached at 972-304-3325 or by e-mail at info@effectiveinventory.com