STAFDA Inventory Consultant on Monitoring Inventory Performance

Three common metrics of inventory performance: Inventory turnover, the turn/earn index and GMROI.

|

|

Achieving effective inventory management is not easy. But it is a requirement for profitability and success.

It is often said that people will do what you inspect rather than what you expect. In these challenging economic times it is critical for every distributor to monitor the performance of what is probably their largest asset, their investment in stock inventory. In this article we will look at three common metrics of inventory performance:

- Inventory turnover (or opportunities to earn a profit)

- The turn/earn index

- Gross Margin Return on Investment (GMROI)

By monitoring improvement in these key indicators (along with the customer service level, which was discussed in our last article) you can track your progress in achieving the goal of effective inventory management.

Inventory Turnover

If we were to ask a typical employee in your company, “What does inventory turnover mean to you?” how would they respond?

- With a blank expression?

- With a grunt?

- By saying “I don’t know”?

- By stating that turnover is what the controller keeps complaining about and what prevents the buyers from stocking enough material to meet the customers’ needs?

While the customer service level (i.e., the percentage of line items for stocked products ordered by customers that were delivered complete, in one shipment, before the due date) is probably the most important inventory measurement, turnover is often the most misunderstood. Let’s clear up this misunderstanding and help all of your employees realize the true value of inventory turnover.

To start with, we want you to take the term “inventory turnover” out of your vocabulary and replace it with the term “opportunity to earn a profit.” Why? Well, we’ve found that when we go into sales meetings and talk about “inventory turnover,” a lot of people yawn. But, if we go into the same meetings and talk about “opportunities to earn a profit,” salespeople suddenly sit up and give us their attention!

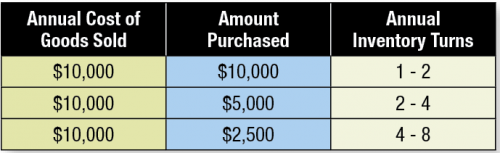

The concept of inventory turnover is best illustrated with an example. Say you sell $10,000 worth of a product (at cost) each year. Total revenue received from sales of the product is $12,500. If we bought the entire $10,000 worth of the product on January 1st, at the end of the year we would have made a $2,500 gross profit on an investment of $10,000.

But do we have to buy the entire $10,000 worth of the product at one time? What if we bought $5,000 worth of the product on January 1st? Then, just before running out of stock, we bought an additional $5,000 worth of the product with part of the revenues received from selling the first shipment. At the end of the year, we’ve still sold $10,000 worth of the product, still made $2,500 gross profit, but at any one time we had a maximum of $5,000 invested in inventory.

Could we make the same gross profit on an even smaller investment? What if we were to buy $2,500 dollars worth of material? Sell most of it. Buy another $2,500 dollars worth of the product. Sell most of that shipment and then repeat the process two more times before the end of the year. The annual gross profit of $2,500 is now generated with a maximum of $2,500 invested in inventory at one time.

Which investment option is better? Selling $10,000 worth of a product (and making $2,500 gross profit) with an investment of $10,000, $5,000, or $2,500? The best option is $2,500. Investing $2,500 (rather than $10,000) frees up $7,500 that can be used for other purposes, such as stocking other products that have the potential of generating additional profits.

Every time we sell an amount of a product, product line, or other group of items equal to the average amount of money we have invested in those items, we have “turned” our inventory. The inventory turnover rate measures the number of times we have turned our inventory during the past 12 months. Here is a list of the turnover rates from our example:

Why the range in annual inventory turns? Because turnover is calculated on the average inventory investment, not the amount purchased at one time. During the time it takes us to sell a specific quantity purchased, about half the time we’ll have more than half the amount purchased and half the time we’ll have less. The average inventory value is usually close to equaling half the amount purchased (plus any reserve inventory or safety stock). We use the following formula to calculate inventory turnover:

If you are calculating turnover for a central warehouse (i.e., a warehouse that supplies material to other company locations) include the value of outgoing transfers in the cost of goods sold value. If you are calculating turnover for a location that uses stock inventory for repairs or assemblies, include the value of stock inventory used for these purposes in the cost of goods sold figure.

However, be very careful about how you determine the cost of goods sold figure for the overall inventory turnover for your company. You only want to include the value of material actually delivered to customers. If you include the value of material transferred between locations or the value of inventory used in assembling kits, you may exaggerate your company’s overall inventory turnover.

Keep these in mind when calculating turnover rates:

- Only consider cost of goods sold from stock sales that are filled from warehouse inventory. Non-stock items and direct shipments are not included. Sure, these sales are important but don’t involve your warehouse stock (i.e. your investment in inventory).

- Inventory turnover is based on the cost of items (what you paid for them) not sales dollars (what you sold them for)

- If the cost of products drastically fluctuates due to market conditions, consider basing turnover calculations on weight or cubic volume of product rather than cost.

Inventory turnover depends on the average value of stocked inventory. To determine your average inventory:

1. Calculate the total value of every product in inventory (quantity on-hand times cost) every month, on the last day of the month. Be consistent: use the same cost basis (average cost, last cost, replacement cost, etc.) to calculate the cost of goods sold and average inventory investment used to determine inventory turnover.

2. If your inventory value tends to fluctuate significantly throughout each month, calculate your total inventory value on the first and fifteenth of every month.

3. Determine the average inventory value: average all inventory valuations recorded during the past 12 months.

How do you determine your turnover goals? Most distributors who have 20-30 percent gross margins should strive to achieve an overall turnover rate of six to eight turns per year. Companies with lower margins require higher stock turnover. If your company enjoys high gross margins, you can afford to turn your inventory less often.

A turnover rate of six turns per year doesn’t mean that the stock of every item will turn six times. The stock of popular, fast moving items should turn more often (up to 12 or more times per year). The inventory of slow moving items may turn only once or not at all.

It’s a good idea to calculate turnover separately for each vendor line in each warehouse every month. This allows you to identify situations in which your inventory is not providing an adequate return on your investment. You’ll see that inventory turnover improve as you start buying the “best buy” quantity of each product and liquidate inventory of dead stock and excess inventory.

Turn/Earn Index

The inventory turn objectives described above are for companies that have overall gross margins between 20 and 30 percent. But if a company enjoys higher margins, it can be successful with lower inventory turns. Many surplus houses justify keeping items in their warehouse for years because they bought the material for pennies on the dollar and will eventually sell some of it for a premium.

The Turn/Earn Index will help you balance turnover and profits. It is calculated by multiplying inventory turns by the gross margin percentage. It highlights situations where high margins can compensate for low inventory turns.

Say, for example, you turn over inventory of an item four times a year and earn an average 30 percent gross margin on each sale. That’s a T/E Index of 1.20. We get the same return if we turn the inventory of an item only twice, but make an average margin of 60 percent on every sale: 2 turns * 60% margin = 1.20.

On the other hand, stock of a product with an average margin of 20 percent has to turnover six times in order to achieve the same 1.20 T/E Index. Your T/E target should normally be at least 1.20 (a line turning six times annually at an average 20 percent margin). “Best practice” distributors usually have a T/E Index above 1.80.

Gross Margin Return on Investment (GMROI)

A similar measurement to the Turn/Earn Index is Gross Margin Return on Investment (GMROI). It also measures the profitability of your investment in inventory. GMROI is calculated by dividing gross profit dollars from sales in the past 12 months by the average inventory investment over the same time period: Gross Profit Dollars from Past 12 Months ÷ Average Inventory Value.

For example, if you earned $20,000 in gross profits from an average inventory investment of $10,000, your GMROI would be 200% ($20,000 ÷ $10,000 = 2.00). In other words you are earning $2.00 for every dollar invested in inventory.

Please note that while the Turn/Earn Index and GMROI both measure profitability, they do so based on two different scales (sort of like Fahrenheit and Centigrade temperatures). Compare the T/E Index and GMROI calculated using the following data:

12 Month Sales Dollars = $8,000

12 Month Cost of Goods Sold Dollars = $6,000

12 Month Gross Profit Dollars = $2,000

Gross Margin ($2,000 ÷ $8,000) = 25%

Average Inventory Value = $1,000

Turnover = ($6,000 ÷ $1,000) = 6.0 turns per year

T/E Index = 6.0 * 25% = 1.50

GMROI = $2,000 ÷ $1,000 = 2.00

The GMROI will always be greater than the corresponding T/E Index. Your GMROI should be at least 1.50 (the equivalent of a T/E Index of 1.20). “Best Practice”

distributors have a GMROI above 2.25 (the equivalent of a T/E Index of 1.80).

Summary

Achieving effective inventory management is not easy. But in today’s environment of more competition and added customer demands of product availability, it is a requirement for profitability and success. Monitor your turnover, turn/earn index and GMROI each month to ensure that you are making progress as you strive to achieve the goal of effective inventory management. CS

Jon Schreibfeder is president of Effective Inventory Management, Inc. He has authored numerous articles and several books on inventory management best practices and is the designated inventory management consultant for STAFDA. Jon can be reached at 972-304-3325 or by e-mail at info@effectiveinventory.com