Nancye Combs: A Wrench in the Works

Avoid these five costly management errors and omissions.

|

|

Although employers experience tax increases when states have revenue loss from lower tax collection, some increases in cost to employers are preventable and are the result of faulty decision-making.

Here are five expensive mistakes that be avoided.

1. Using “At-Will” Terminations

Most states allow employers to terminate employees with or without cause, if there is no employment contract, no violation of public policy or no discrimination. That means many employers can decide to end the employment relationship with an employee whenever they want to, with or without a reason. The naïve manager says, “I know we should have properly documented his problems, but we can use our at-will privilege to get him out of here.”

No problem, right? It is easy, fast and covers your managerial sin of failing to properly address and document the performance issues. Keep in mind that your employee will qualify for unemployment insurance and your company will pay for it. If you terminate at-will, and do not have any documentation to support that decision, the Unemployment Commission will list it as a “Discharge without Cause” and the employee will be eligible to receive a minimum of 26 weeks of unemployment benefits.

When you dip into your unemployment account, your tax rate will rise if your reserves go down. Your decision with one employee will affect the cost of every employee. It is far less expensive to develop a performance management system that allows you to meet with employees regularly and have honest discussions about performance

issues that you can document. Terminating “at-will” is not free.

2. No restrictive covenants

When a small distributor explained to me that his sales manager and sales representative left suddenly, took all of the price and customer lists, then set up a business and began selling to his customers, I asked the obvious question, “Did you have a noncompete and confidentiality agreement?” His answer was, “No.” In addition, there was no handbook.

Why? He explained that he has a small company with no HR Department and he cannot afford to have all of the things big companies have. He is wrong, of course, and he is also in panic mode because he also had no technology policy about downloading company information onto personal computers and both employees left with all of the company information.

Noncompete and confidentiality agreements are neither difficult nor expensive. THEY ARE NOT A WASTE OF TIME. They are not as easy as fill-in-the-blanks, but close. Once you know the ground rules, you can make them stick and protect what you have worked for all of your life.

- Create a confidentiality policy that applies into perpetuity.

- Make certain that your noncompete is reasonable. I have seen noncompetes enforced that cover a reasonable geographic area (500 miles), or a specific list of customers, and are for a reasonable period of time (one year).

- Be certain the noncompete is signed before the employee starts working.

- Create a handbook that includes a confidentiality statement. It does not need to be an all-inclusive document. Have every employee sign for a copy. '

- While creating policies and procedures is not totally free, they are affordable for even a small company and much less expensive than the alternative.

3. Ignoring Pay Practices Laws

There were 30,000 Wage and Hour Complaints filed with the U.S. Department of Labor Wage and Hour Division last year. This is more than all other discrimination complaints combined. The number of wage and hour complaints has grown by 400 percent over the last five years. There are two major areas that managers ignore when making pay decisions — employee status and overtime. Both are expensive to fix.

The law covering whether you pay overtime to an employee is not flexible. Basically, it is based on the “scope of the work.” There are many rules but the decision can never be based on whether the employer and the employee agree that the employee will paid a salary without overtime or whether the employer decides that the employee will be paid a salary to avoid overtime pay.

If the employee does not qualify to be exempt from overtime under the law, then the employee must be paid overtime. The penalty for failure to pay overtime is very expensive.

Another major problem that can be expensive is paying an employee as an “independent contractor.” It is a huge problem and the IRS is looking specifically for employers who violate these regulations. The U.S. Department of Labor has regulations that define what constitutes an employer-employee relationship. They are printed in the Fair Labor Standards Act.

There are also rules that define who can be called an “independent contractor” that were published by the IRS. Those rules are called the 20 Factor Test. You can find them easily on the Internet or at the IRS website. To pay a person as an independent contractor, you must be able to meet the 20 Factor test. If the individual is paid as a contractor and should have been paid as an employee, then you will have back payment for unpaid employer taxes, benefits, overtime and anything else the individual should have been paid during the time he/she was misclassified, along with the penalty.

It is widely known that many employers avoid the employer taxes and benefits by putting employees on “independent contractor” status. Because the U.S. Government is desperately seeking more revenue, it is aggressively addressing issues such as misclassification of employees. This is an area where it is dangerous to think that you can have a “free lunch.”

4. Failing to Check Out Job Applicants

One in four job applicants lies about their background. The most frequent lie is about education. They also lie about their criminal record. Employee theft is at an all time

high — two-thirds of all inventory loss is internal. The problem has grown as the economy has worsened, especially in companies that sell products that can be pawned, re-sold, or sold as scrap (copper wire). These are enough reasons to be sure you check the record of every person you hire.

Some resources are free. Go to the Department of Justice and conduct a free sex offender search. It is easy and covers all of the United States. Go to the Council on Higher Education Accreditation to verify the college or university your applicant listed is a legitimate school.

A recent list of phony schools totaled 22 pages. Many of these schools are nothing more than a post office box, where a person may pay a fee and receive a beautiful degree for $69.95. Diploma mills are rapidly increasing.

Although these two record checks are free, checking criminal records is not. It may cost a few bucks, but the omission can cost millions.

5. Offending Decision Makers

If you spend a little time with the New Millennium generation, you will quickly learn that they have definite attitudes about the “Stone Agers and Older Boomers.” In many occupations, including distribution and sales, they are usually referring to men with grey hair and no hair and women who talk “down” to those under 30.

In years past, sales reps have been a fraternity. They had great relationships with buyers and with other decision makers that evaporated when the big box stores moved in and manufacturing moved overseas.

In years past, sales reps have been a fraternity. They had great relationships with buyers and with other decision makers that evaporated when the big box stores moved in and manufacturing moved overseas.

The decision-maker may now be a young, well-educated female, who is offended by false flattery or being addressed as “sweetheart” or “honey.” All that talk about being “politically correct so you won’t be sued” makes her cringe because she knows that being politically correct should be about respect, not lawsuits.

Although she may be respectfully silent, her memory is sharp and she will record every condescending act and word spoken to her, when she selects vendors. She remembers the rep whose lunchtime conversation focused entirely on the gay lifestyle of her predecessor and the woman who constantly called her “dear.”

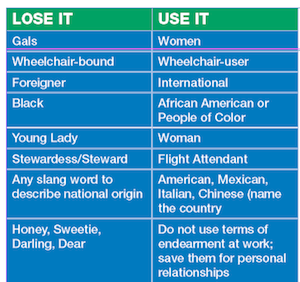

Although there is an obvious discomfort among some when the subject of diversity is raised, those who want to be successful in selling to the new generation accept that they must close the generation gap. They recognize that English is a dynamic language and changes with every generation. Some words and phrases are out-of-date and have been replaced with the language of the new millennium. They accept that if they don’t want to be viewed as “old” they cannot talk “old.”

“Stone-Agers” know that the newest generation in the workforce is savvy with technology and wants the latest electronic gadgets and equipment. They communicate by email and text message because it is the communication method of choice among the newest generation. They embrace the process to go paperless and they are comfortable going to work armed only with a smartphone and a tablet computer — the same tools their children and grandchildren are using.

They don’t disparage those who leave the office without a briefcase because they know that the new generation has a flash drive in their pocket that holds the equivalent of 12 file cabinets.

Those who discount the importance of generational differences will be disappointed they have not kept up with the fascinating new generation of employees who have joined the workforce in the past ten years and are moving into decision-making roles. They will regret they did not keep a positive and modern up-to-date presence on the web for themselves and their companies. That presence attracts achievers.

“Stone Agers” still using any of the “Lose It” terms should replace them with those on the “Use It” list above. Then, you can expect some New Millennium colleague to say you

are “awesome!” CS

Nancye Combs is president of HR Enterprise, Inc. in Louisville, KY. She is the endorsed Human Resources consultant for five major trade associations including STAFDA. She consults with manufacturing and distribution trade association members throughout the world. She is also a member of the MREF faculty for those who are seeking to become a Certified Professional Management Representative (CPMR). She can be reached

at 502-896-0503 or by email at nancyecombs@aol.com.