Special Report: The Solar Industry 2012

Solar Industry and construction trends for 2012 and beyond

The surface of the sun is interspersed with brilliant flairs of brightness and areas of relative inactivity. The same might be said of the utility-scale solar market. A recent burst of activity has tripled installations in just two years, but areas of doubt and uncertainty remain.

Continued enthusiasm for solar energy was underscored by attendance of over 30,000 stakeholders at this Fall’s 2011 Solar Power International (SPI) conference. Mortenson Construction gathered feedback from 265 professionals at the show to conduct this study. Respondents represented a broad array of organizations, including utilities, developers, independent power producers (IPPs), financiers and module and equipment suppliers.

The majority were very optimistic, convinced that solar would outpace other renewable alternatives and reach cost parity with coal and gas within 10 years. This

optimism is natural given recent growth, as well as technological and manufacturing advancements and decreasing solar energy costs.

However, the solar industry is also at a moment of uncertainty. Respondents acknowledged vulnerability to government policy and continuing budget deficits. The industry continues to face significant structural challenges in areas such as transmission infrastructure and energy storage.

Utilities were less optimistic about growth and new technologies than many of the suppliers and developers. Lastly, after conducting this survey, SolarWorld Industries filed a controversial, antidumping lawsuit against Chinese module manufacturers. It’s unclear what effect this suit will ultimately have on the solar industry.

In the Sweet Spot

Solar energy has entered an expansion phase of high growth driven by technological advancements and falling module prices.

The growth of solar is attracting many new participants. The average respondent in our survey has worked in renewable energy only 4.4 years. Those who have worked in renewables for at least 10 years have worked for an average of 3.6 renewables companies, reflecting the high degree of transition that exists across many companies.

Differing Outlooks

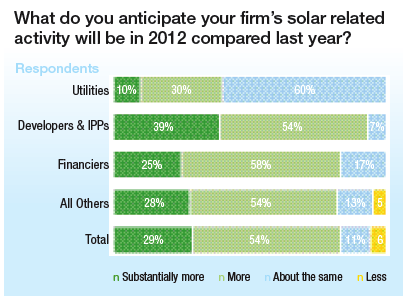

A full 93 percent of developers and IPPs expect their firm’s solar business to grow in 2012, while only 40 percent of utility companies expect the same. This suggests that the numerous solar projects being planned by developers and IPPs may be chasing a more limited number of utilities looking to expand solar purchases—perpetuating the highly competitive environment that exists for new projects.

Mortenson asked utilities to list the most important criteria they use to choose developer and IPP partners from which to purchase energy:

- 35 percent of participants mentioned low cost

- 20 percent cited experience and/or technical ability

- 20 percent also mentioned a firm’s ability to deliver the project as promised and on time.

- 10 percent mentioned financial strength and location

Ultimate Energy Parity

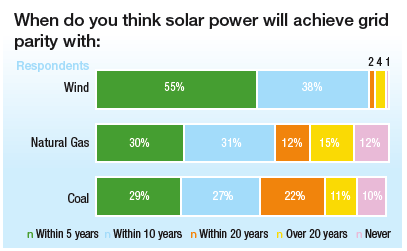

In the long-term, attaining grid parity against other energy sources is the challenge facing solar. In this regard, participants who took the survey were also optimistic that solar will meet the challenge and outgrow other energy options.

A solid 71 percent of participants felt solar will surpass wind energy in annual generating capacity additions, even though current new wind capacity is five to six times greater.

Perhaps more surprising, well over half of participants felt solar will achieve grid parity with fossil fuels within the next 10 years — only 12 percent felt that solar would never reach competitiveness.

Optimism in solar competitiveness is understandable given historical trends. The per-watt price of solar modules has dropped from $22 in 1980 to under $3 today, and has fallen 40 percent in the last year alone. Still, the kilowatt-hour cost of solar electricity is about three to four times that of coal or natural gas today. It remains to be seen whether technological advancements can bridge this gap, but there is no doubt participants who took the survey believe solar will accomplish this.

Where the Action Is

Participants also named the states they felt offered the best overall environment (regulatory, incentives, weather, etc.) for the development of solar projects. California was the clear winner, followed by Texas. California law requires utilities to generate 33 percent of their electricity from renewables by 2020 — the most ambitious target established by any state. Several participants pointed out that solar enjoys solid popular and political support in California as well. The top states in order were California, Texas, Arizona, Colorado, Florida and Massachusetts.

Significant challenges to solar progress and energy parity remain, among them pricing pressures, the loss of government incentives, politics and infrastructure and connectivity concerns. However, given the current climate, the outlook for solar construction, contractors and their suppliers remains bright into the foreseeable future.

The challenge and opportunity for construction supply distributors is to get ahead of the curve. Distributors need to learn and help pioneer the tools, structural and mechanical components — those currently in use and those in development — so they can add value to the process by helping contractors build more efficiently and cost effectively as the industry enters its next phase. CS

This article excepts a study conducted by Mortenson Construction. Its Mortenson Renewable Energy Groups division has constructed more than 100 wind and solar projects generating over 11,000 megawatts of clean renewable energy across the United States and Canada. Mortenson is ranked the 11th largest power contractor in the United States. For a full copy of the report visit: http://www.mortenson.com/Resources/Images/15287.pdf.