Wells Fargo Releases Q2 Construction Quarterly

Overall construction gains 7% for quarter year over year.

Summary: Overall construction spending loaded up a 7% gain compared to a year ago in spite of decreases in public infrastructure spending. Unseasonably warm weather and low interest rates may have given an early spring start to a housing recovery.

The U.S. economy continues its dicult but sustained path toward recovery, but the pace of this recovery is not satisfying anybody, as the rate of unemployment remains elevated and job growth is positive but not strong enough to change the perception regarding the future.

While the rate of economic growth during the first quarter of the year was not as strong as analysts were expecting, 2.2 percent versus the consensus estimates of 2.5 percent, with some concerning underlying numbers, especially within business investment, consumer expenditures remained relatively strong, outpacing the growth in GDP to post a 2.9 percent annualized rate during the quarter. If sustained, this growth in consumption

will keep the U.S. economy on the right path throughout the rest of the year.

Construction spending report by the U.S. Dept. of Commerce

Overall construction spending in March 2012 at a seasonally adjusted annual rate (SAAR) was an estimated $808.1 billion, up 0.6% from the revised February estimate of $807.3 billion.

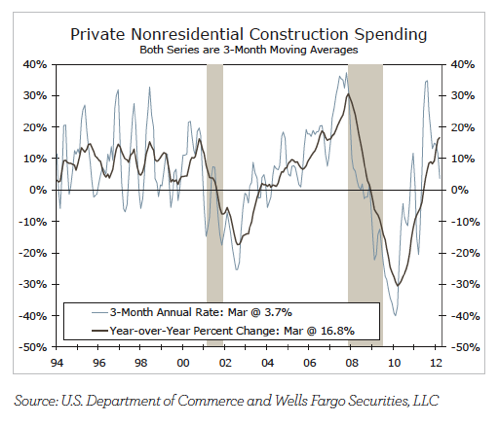

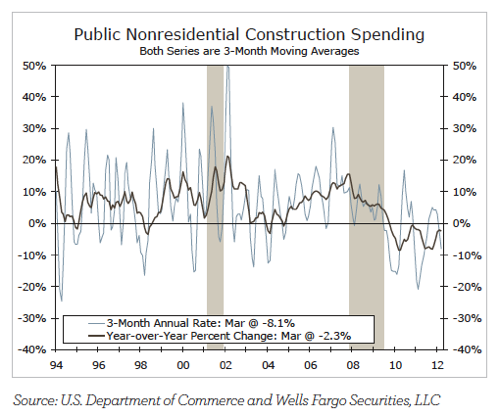

Private non-residential construction totaled $287.8 billion, 0.7% above the revised February estimate of $285.7 billion. Highway and Street construction spending in March was $77.0 billion, 0.8% below the revised February estimate of $77.6 billion.

Total Non-residential spending (public + private) amounted to $556.9 billion, a 5.7%

increase over the March 2011 estimate of 526.7 billion but a 0.2% dip

compared to February 2012.

Housing improves

Meanwhile, the news coming from the U.S. housing market continues to improve, albeit at a very slow pace, and our expectation is for the housing market to continue to make

improvements.

Rental Snapshot

United Rentals, Inc. announced Q1-2012 total revenue of $656 million compared with total revenue of $523 million in Q1-2011 and $746 million in Q4-2011.

As it finalizes details for the merger with United Rentals, RSC announced total revenue for Q1-2012 was $408 million compared to $327 million in Q1-2011 and $421 million in Q4-2011.

Hertz Equipment Rental Co. (HERC) reported Q1-2012 revenues of $302.1 million, a 12.6% increase over Q1-2011 revenues of $268.2 million. Adjusted net income for the most recent quarter improved to $17.1 million from $6.7 million in Q1-2011.

Click here to download the complete report from Wells Fargo.