COVID-19 downturn won't match Great Recession

Alan Beaulieu predicts that the economic impact of the COVID-19 pandemic won't be as severe as the Great Recession.

by Rich Vurva

Economist Alan Beaulieu of ITR Economics predicts that the economic impact of the COVID-19 pandemic won't be as severe as the Great Recession in 2008-2009.

Economist Alan Beaulieu of ITR Economics predicts that the economic impact of the COVID-19 pandemic won't be as severe as the Great Recession in 2008-2009.

In a webinar titled "Economic Guidance During Uncertain Times," hosted by the Industrial Supply Association's new digital platform The Channel, Beaulieu provided his perspective on the impact that two “black swan events” – COVID-19 and oil price volatility – will have on the economy.

He said that the economic turmoil caused by the pandemic – and decisions by the federal government and states to effectively shut down the economy in order to slow the spread of the virus – will be painful but not devastating.

He credits moves by the Federal Reserve Board in quickly lowering interest rates when the pandemic began to spread for lessening the impact of the virus on the economy.

"I don't like a lot of government intervention, but if you're going to intervene, do it right, and the Federal Reserve Board came in and did it right," he said."The lesson they learned in 2008-2009 was do not come in half-hearted. If you're going to come in, come in big. Go big or go home." He added that funneling money into credit markets, and providing funding to the SBA as a result of the CARES Act legislation to support business, were additional positive moves by the government that will aid an economic recovery.

The retail segment problems will likely extend until late 2020 or early 2021, he said.

"Negative pressure on this part of the economy is always bad news, but it's not nearly as steep as in 2008-2009, which was three times steeper." He added that the decline was caused by the stay-at-home orders issued by various states and the soaring unemployment rate. As states begin to open up their economies, expect to see signs of life in the economy.

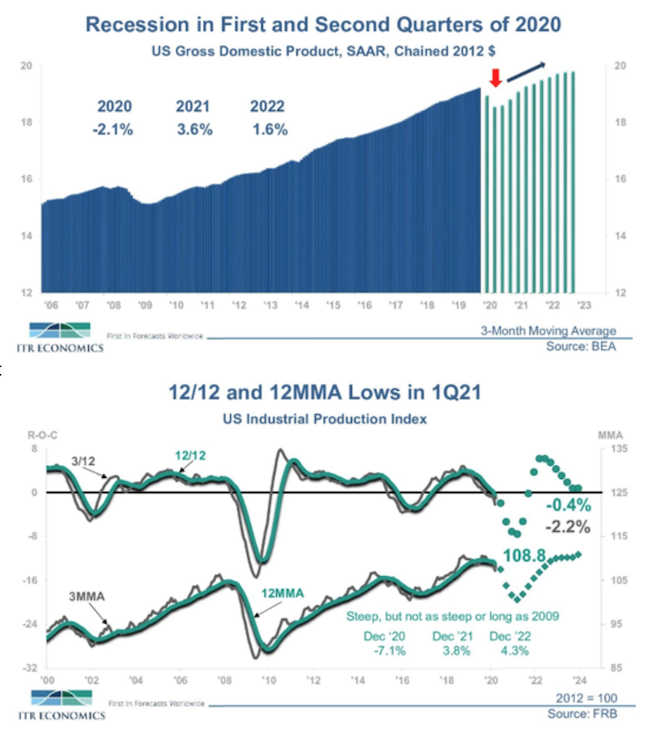

Beaulieu also expects that gross domestic product will decline sharply in the second quarter.

"Understand that macroeconomic pressures will be monstrously negative in the second quarter. How bad? Put down 3.2 percent from March. That doesn't sound like a big number, but let me put into context. That's the steepest second quarter decline since 1981."

Beaulieu said that while the decline in the U.S. Industrial Production Index will be steep, it likely won’t match the decline seen during the Great Recession. "The 12-month moving average shows a steep decline, but it's not as steep as 2009," he said. "It's going to be a 8.2 percent decline and we're going to feel every moment of that, but it is milder than 2008-09 if you want to keep it in perspective."

Beaulieu offered encouraging words to boost the spirits of industry employees who may be concerned about the future. "Think back on your history. What do Americans do when there's a pile of rubble? We climb out, we build, we go forward. And I don't think we're done doing that."

ISA member sentiment

Prior to the webinar, ISA surveyed its members about the impact of the pandemic on their businesses. The results showed that the impact will be severe, but many feel it won’t be long lasting.

"The sentiment around revenue by month showed that April is expected to have the deepest decline, with a negative 21.5 points versus the same month prior year. But there’s optimism about incremental improvement by month going forward,” said Ed Gerber, ISA president and CEO.

ISA members listed a variety of actions their companies have taken in response to the pandemic. The top actions focused on freezing expenses vs. reductions in compensation or headcount. Other actions being taken by ISA members include delaying purchases, inventory reductions and returns, temporary shutdowns and rotating staff in two-week increments to avoid layoffs, suspending 401(k) employer matches and eliminating overtime.

Ninety-four percent of the respondents to the survey indicated that they have staff working remotely.

The big question on everyone's mind, said Gerber, is when will the industry get back to normal?

“The sentiment to when we’ll get back to normal run rates varied quite a bit, which makes sense because none of us has experienced anything like this before,” Gerber said. “We had responses from May of this year all the way to January 2022. The largest number of responses, about 37 percent, suggested a return to normal by October of this year. Fifteen percent of respondents think it will take until the first quarter of 2021 before normal run rates return."

More than 800 people registered for the webinar, which can be viewed by ISA members when it is posted on the ISA website.