Global Forklift Shipments Growth Remains Robust Despite Near-term Headwinds

Consistent growth of 4 to 5 percent is forecast over the next 10 years.

- Annual growth in global forklift shipments in 2021 and 2022 was constrained by supply chain issues related to COVID-19 control measures, rising inflation rates and the war in Ukraine

- Consistent growth of 4-5% is forecast over the next 10 years as rising labor costs places pressure on companies to reduce costs and adopt automation

- APAC will continue to dominate, accounting for over half of global shipments

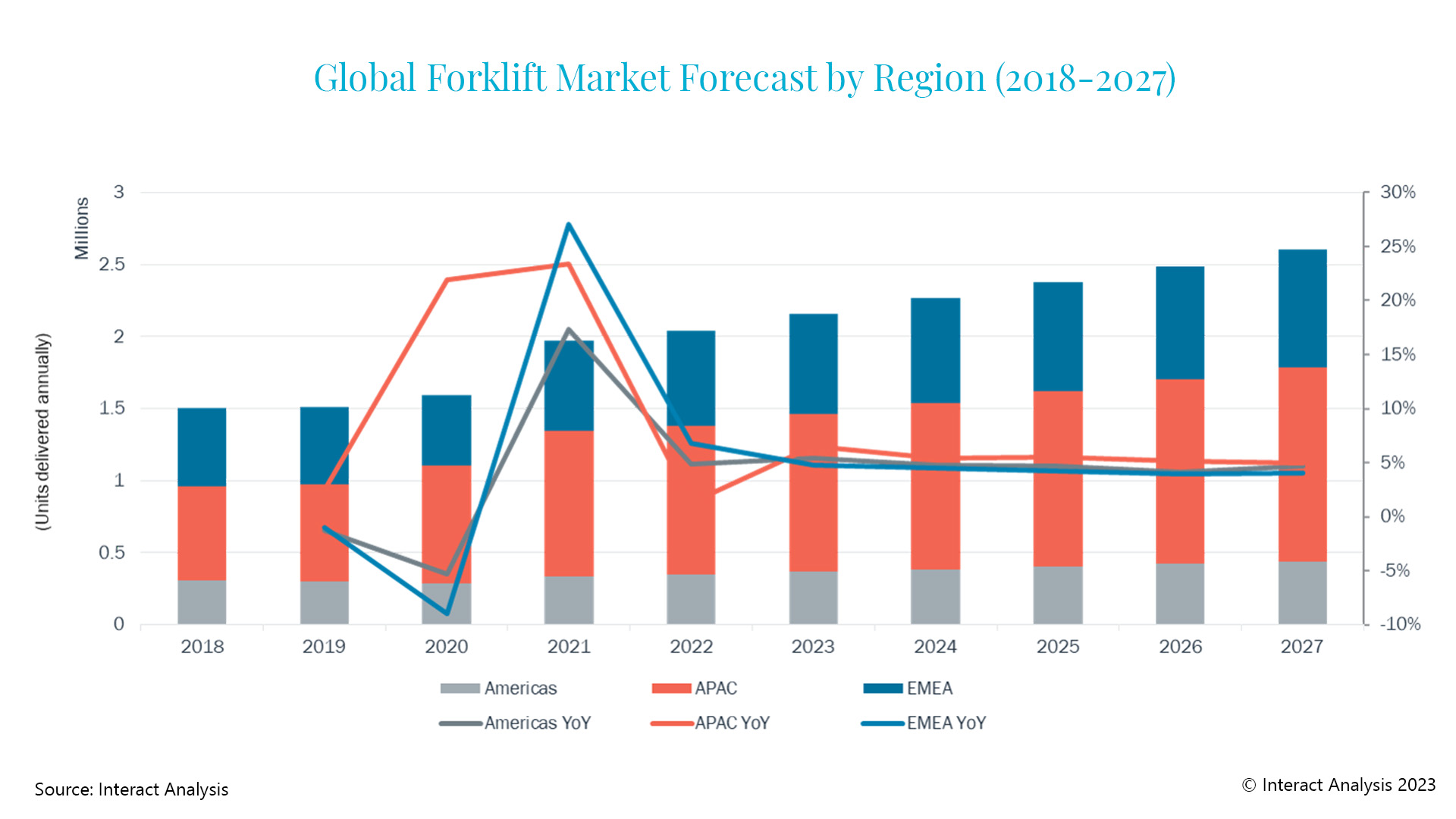

London, 24th January 2023 - The global forklift market is expected to experience consistent growth of 4%-5% over the 10 years out to 2032. But new research shows that worldwide economic turbulence and inflation continued to curtail growth in 2022. According to Interact Analysis’ Global Forklift Market – Dec 2022 report, although growth was lower in 2022 than previously forecast (4% versus 8% in the previous edition), the overall forecast remains robust and consistent over the ten-year period.

Growth in forklift shipments plateaued in 2019, having been at a low level for several years. The Covid-19 pandemic, supply chain constraints and delays in project completion caused a widening gap between order intake and shipments. Shipment growth is set to continue in 2022 and 2023, as most suppliers are still processing 2021 orders.

However, there is a 10% decline in orders forecast for 2022. In addition, prices are being driven up by rising materials, energy and logistics costs, as well as by the war in Ukraine and Covid lockdowns in Asian countries.

The impact of COVID-19 continues to affect shipments of forklifts - not only economic turbulence and government policies to tackle spending and inflation - but also, the control measures in APAC have led to a low production rate which in turn worsens delivery efficiency.

The ongoing war in Ukraine is also negatively affecting sales globally, particularly within the European region. All these factors have weakened investment in large-scale factory and warehouse automation projects and made investors more cautious. This cautiousness continues among both manufacturing and warehousing automation customers throughout 2022 and is expected to carry into 2023.

However, the core driver for forklift market growth has not changed: the continuing rise in labor costs is placing pressure on companies to push ahead with their automation plans and reduce demand on manual labor. As a result, demand for automation equipment is set to continue rising steadily over the long term. Electrification will continue to be a key trend in the global forklift industry.

Within the EMEA region, automation investment in Eastern Europe has increased sharply in recent years, but the war in Ukraine is expected to constrain growth in the short to mid-term (2022 and 2023). Within the Americas, rising inflation and interest rates have led to caution among investors when it comes to large-scale automation projects.

And in the APAC region, repeated Covid-19 waves and lockdowns in Asian countries, have caused a sharp decline in forklift shipments following two years of growth. This decline is expected to continue into the first half of 2023. From 2023, shipments in APAC will grow with a CAGR of 5.3% to 2027. Investment in all regions is expected to resume as inflation eases and global uncertainty subsides.

Maya Xiao, Senior Analyst at Interact Analysis, comments, “After 2021’s sharp recovery, 2022 was a ‘cold’ year for the global forklift market, with problems in all regions. APAC registered the lowest growth accounting for 50.4% of total shipments. By 2029 global shipments of forklifts are predicted to exceed 3 million a year, with APAC expected to account for 52% of the total.”

APAC experienced the lowest growth in 2022 accounting for 50.4% of shipments.

“Electrification, particularly Li-ion battery technology, is a growing trend that is showing no signs of slowing down as markets for new energy vehicles continue to boom. This is expected to continue within the global forklift industry, as shipments of forklifts with traditional engines decline over the next 10 years and electrified vehicles take their place.”

About the Report:

The 3rd edition of the Interact Analysis market report on the global forklift industry. The report focuses on Class 1-5 forklifts mainly in manufacturing and logistics environments with electrification and autonomy trends.

Forklifts have seen new growth and demand in recent years driven by the rapid development of smart manufacturing and intelligent warehouses. External factors such as the strict emission standards and rising labor costs are also fueling demand, as the trend toward electrification becomes significant in the global forklift market.

About Interact Analysis

With over 200 years of combined experience, Interact Analysis is the market intelligence authority for global supply chain automation. Our research covers the entire automation value chain – from the technology used to automate factory production, through inventory storage and distribution channels, to the transportation of the finished goods. The world’s leading companies trust us to surface robust insights and opportunities for technology-driven growth. To learn more, visit www.InteractAnalysis.com