Equipment Finance Market Remains Steady Foundation Says

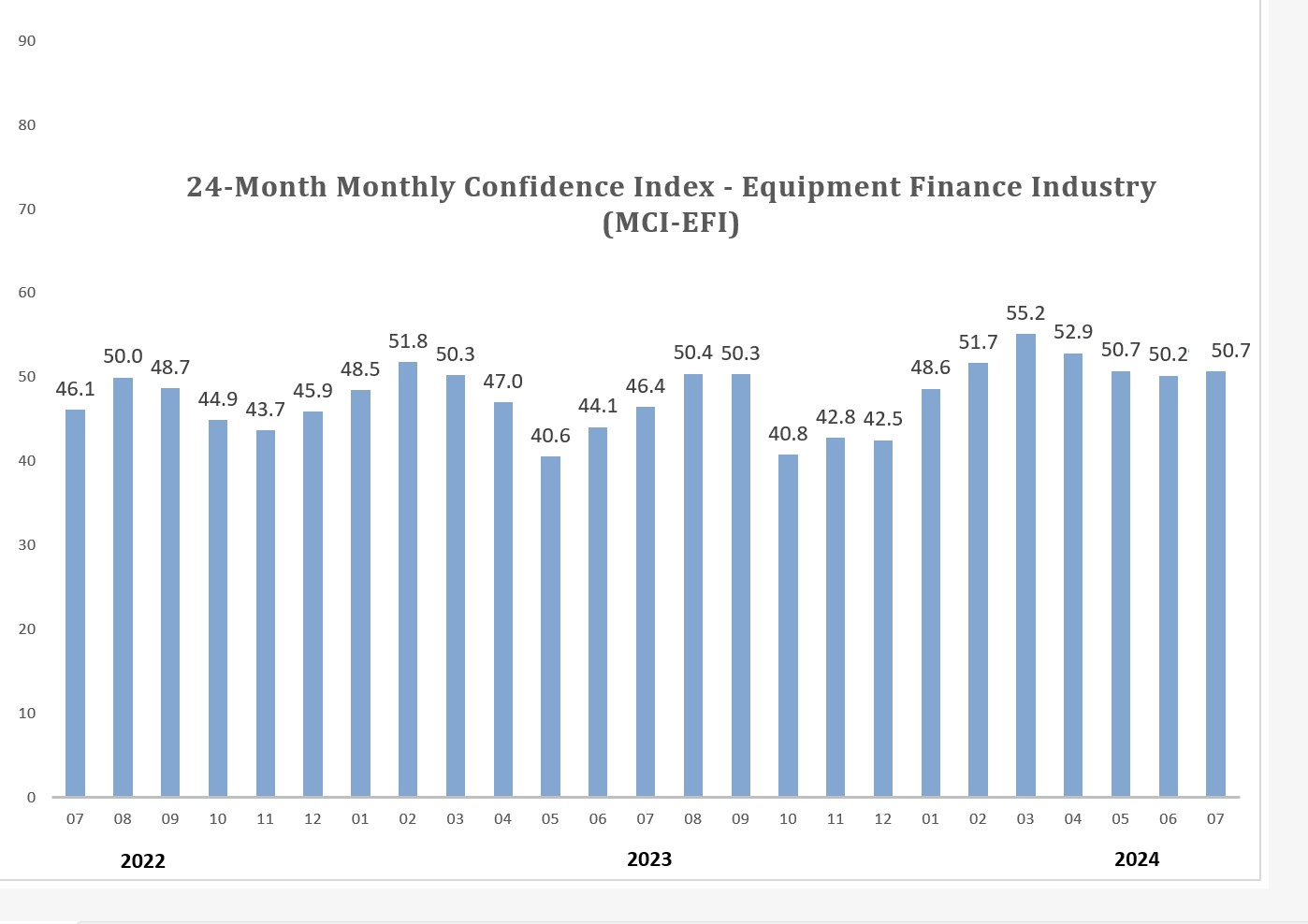

Overall, confidence in the equipment finance market remains steady according to the July 2024 Monthly Confidence Index for the Equipment Finance Industry released by the Equipment Leasing & Finance Foundation.

Per the survey, the overcall MCI-EFI is 50.7, which was steady with the June and May MCIs of 50.2 and 50.7, respectively. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector.

Per the survey, the overcall MCI-EFI is 50.7, which was steady with the June and May MCIs of 50.2 and 50.7, respectively. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector.

Industry leaders are still cautiously optimistic.

“Companies are falling behind on capex, but the need for replacement is necessary, despite rising costs and increased financing expenses,” said Lyndon Thompson, president, of Byline Financial Group. “Upgrades are essential for growth and to stay competitive, though it’s unlikely costs will decrease in the foreseeable future.”

The financial environment for small ticket equipment leasing is testing business models according to David Normandin, president, and chief executive officer of Wintrust Specialty Finance.

“Some will demonstrate a strong resilience and others will illustrate portfolio performance issues,” he said.

Normandin noted that either way, times of stress strengthen business practices and make the industry stronger eventually.

“I am confident that the equipment leasing and finance industry will become stronger and adapt to continue to meet the needs of our customers in new ways,” Normandin said.

On the independent side of the table, industry leaders continued to express their concern about the high interest rates.

“Inflation (higher than acceptable), high interest rates, and robust federal government spending continue to put a drag on the economy,” said James D. Jenks, CEO, of Global Finance and Leasing Services, LLC.

Mark Bonanno, president and chief operations offficer, of North Mill Equipment Finance, shared a similar thought.

“My main concern is the Fed will remain stubbornly restrictive and overshoot sticking to a 2% inflation mandate,” he said. “Very little makes me optimistic, with the impending election most likely causing a stalemate.”

Complete survey results are available here on the Equipment Finance Foundation website.

July 2024 Survey Results

The overall MCI-EFI is 50.7, steady with the June index of 50.2. Here are some of the highlights from the survey:

- When asked to assess their business conditions over the next four months, 3.9% of the executives responding said they believe business conditions will improve over the next four months, a decrease from 11.5% in June. 76.9% believe business conditions will remain the same over the next four months, unchanged from the previous month. 19.2% believe business conditions will worsen, up from 11.5% in June.

- 11.5% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, up from 7.4% in June. 73.1% believe demand will “remain the same” during the same four-month period, down from 77.8% the previous month. 15.4% believe demand will decline, a slight increase from 14.8% in June.

- 19.2% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, unchanged from June. 76.9% of executives say they expect the “same” access to capital to fund business, up from 73.1% last month. 3.9% expect “less” access to capital, down from 7.7% the previous month.

- When asked, 23.1% of the executives report they expect to hire more employees over the next four months, a decrease from 25.9% in June. 69.2% expect no change in headcount over the next four months, up from 66.6% last month. 7.7% expect to hire fewer employees, unchanged from June.

- None of the leadership evaluated the current U.S. economy as “excellent,” down from 3.9% the previous month. 84.6% of the leadership evaluate the current U.S. economy as “fair,” up from 76.9% in June. 15.4% evaluate it as “poor,” down from 19.2% last month.

- 19.2% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, up from 14.8% in June. 57.7% say they believe the U.S. economy will “stay the same” over the next six months, an increase from 48.2% last month. 23.1% believe economic conditions in the U.S. will worsen over the next six months, a decrease from 37% the previous month.

- In July, 19.2% of respondents showed they believe their company will increase spending on business development activities during the next six months, an increase from 14.8% the previous month. 73.1% believe there will be “no change” in business development spending, down from 77.8% in June. 7.7% believe there will be a decrease in spending, unchanged from last month.