Construction Industry Job Openings Plummet in June

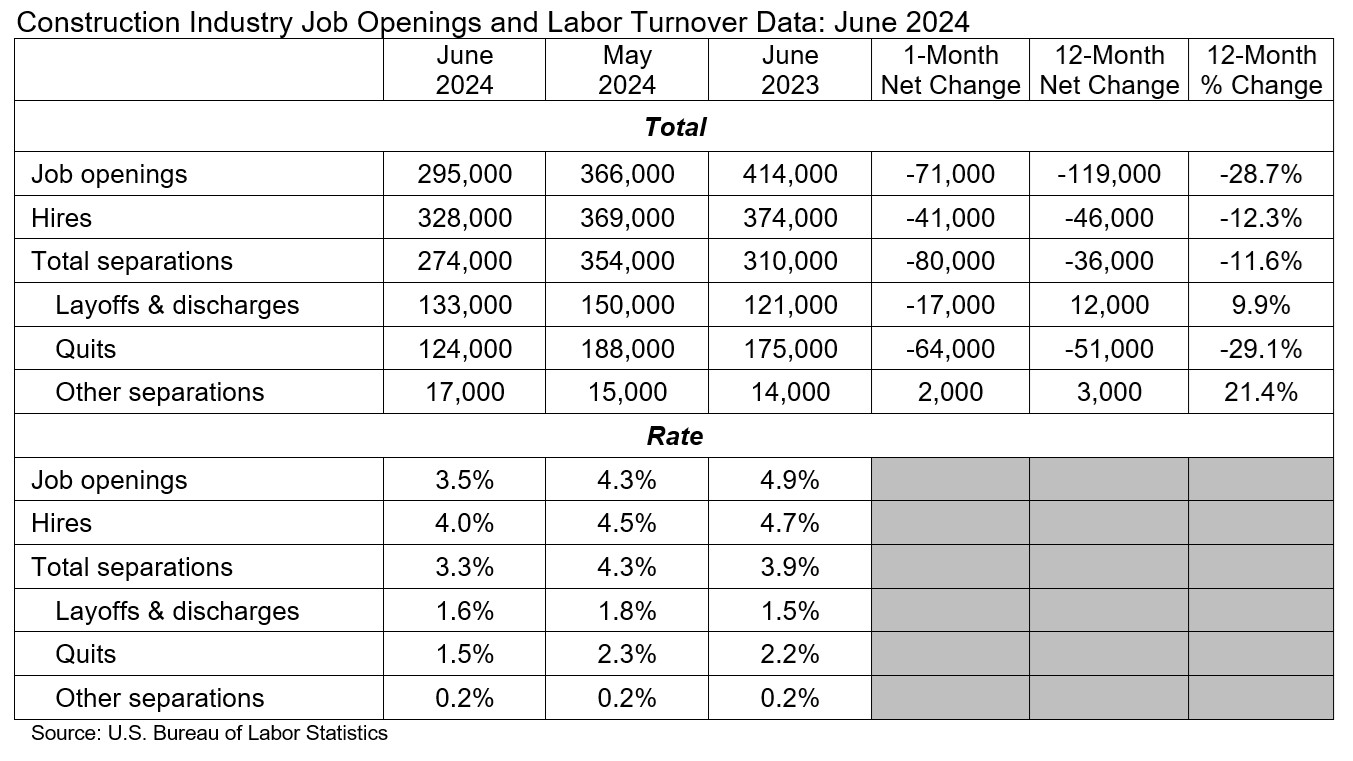

Analysis by the Associated Builders and Contractors (ABC) and National Association of Home Builders (NAHB) shows that the construction industry had 295,000 job openings on the last day of June.

Due to slowing home construction and elevated interest rates, the count of open construction sector jobs shifted lower in June, per the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey (JOLTS).

Due to slowing home construction and elevated interest rates, the count of open construction sector jobs shifted lower in June, per the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey (JOLTS).

Per the federal report, a job opening is defined as any unfilled position for which an employer is actively recruiting. Industry job openings decreased by 71,000 in June and are down by 119,000 year-over-year.

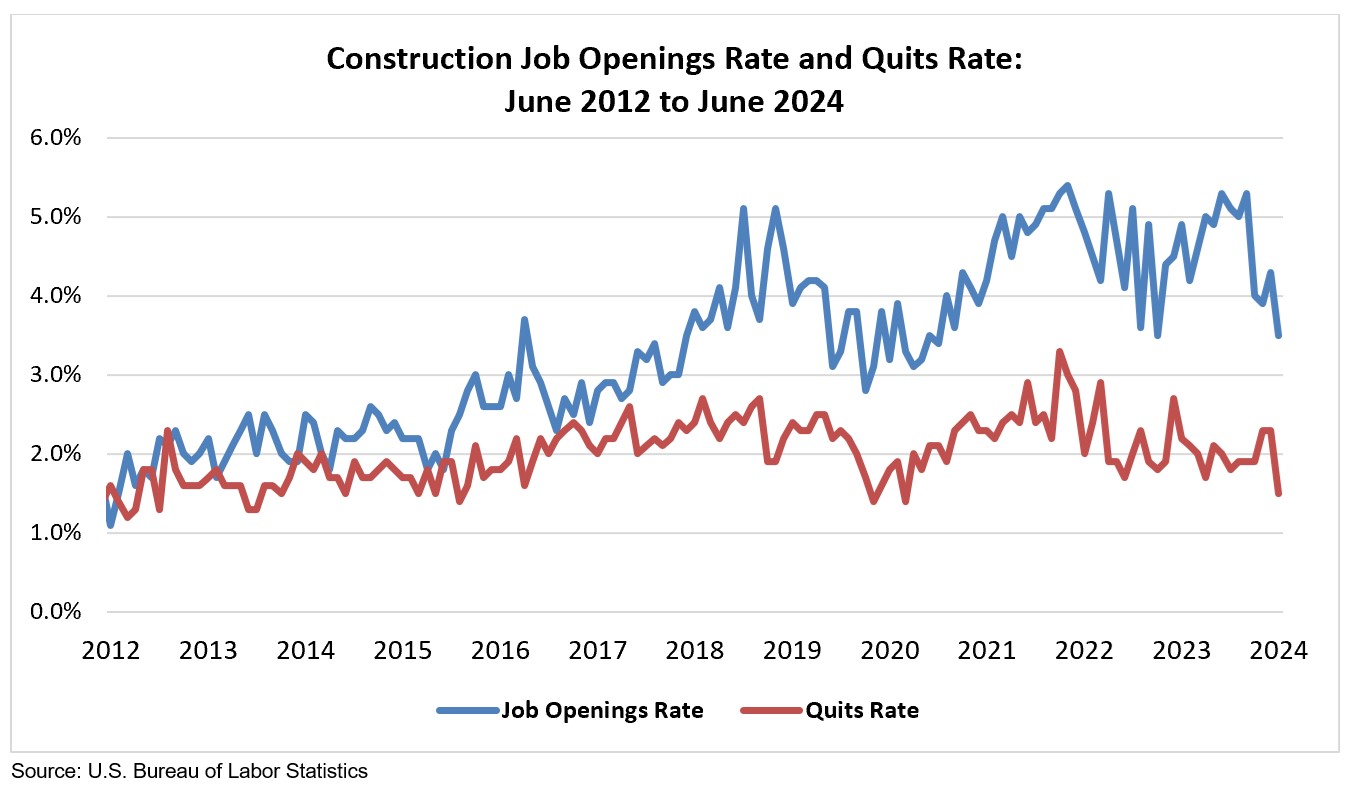

The construction job openings rate fell to 3.5% in June, the lowest rate since March 2023. Both NAHB chief economist Robert Dietz and ABC chief economist Anirban Basu attributed the sharp decline to a cyclical effect and a slowing trend in the overall residential sector.

In addition, the high interest rates have continued to weigh on the industry. Specifically, the multifamily development has slowed, partially reducing the demand for workers and lowering the overall job opening count. Last year, the job count was listed as 414,000.

“While the Fed intends for higher interest rates to have an impact on the demand-side of the economy, the ultimate solution for the persistent, national labor shortage will not be found by slowing worker demand, but by recruiting, training and retaining skilled workers,” Dietz said.

He noted that the reduction in job openings is consistent with a somewhat cooler labor market, which is a positive sign for future inflation readings and the interest rate outlook.

According to his analysis, after revisions, the number of open jobs for the overall economy decreased slightly from 8.23 million in May to 8.18 million.

According to his analysis, after revisions, the number of open jobs for the overall economy decreased slightly from 8.23 million in May to 8.18 million.

Dietz said that this number likely must fall below 8 million on a sustained basis for the Federal Reserve to feel more comfortable about labor market conditions and their potential impacts on inflation. However, with estimates near 8 million now, there is a suggestion that rate cuts lie in the months ahead if current trends hold.

“Nonresidential construction retains momentum due to strength in certain segments like manufacturing and infrastructure, and that should keep the demand for labor elevated,” Basu said. “A majority of contractors intend to increase their staffing levels over the next six months, according to ABC’s Construction Confidence Index, while fewer than 9% of contractors expect their staffing levels to decrease over that span.”