Construction Industry Adds 34,000 Jobs

A total of 34,000 jobs were added in the construction industry in August.

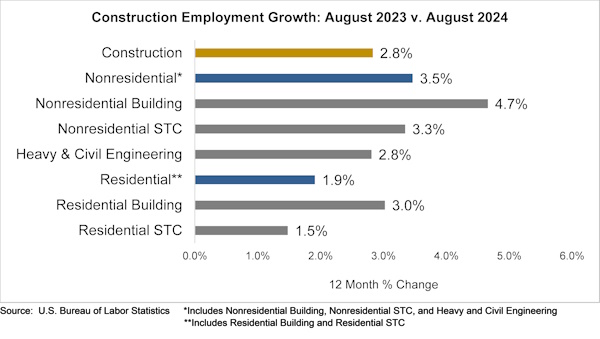

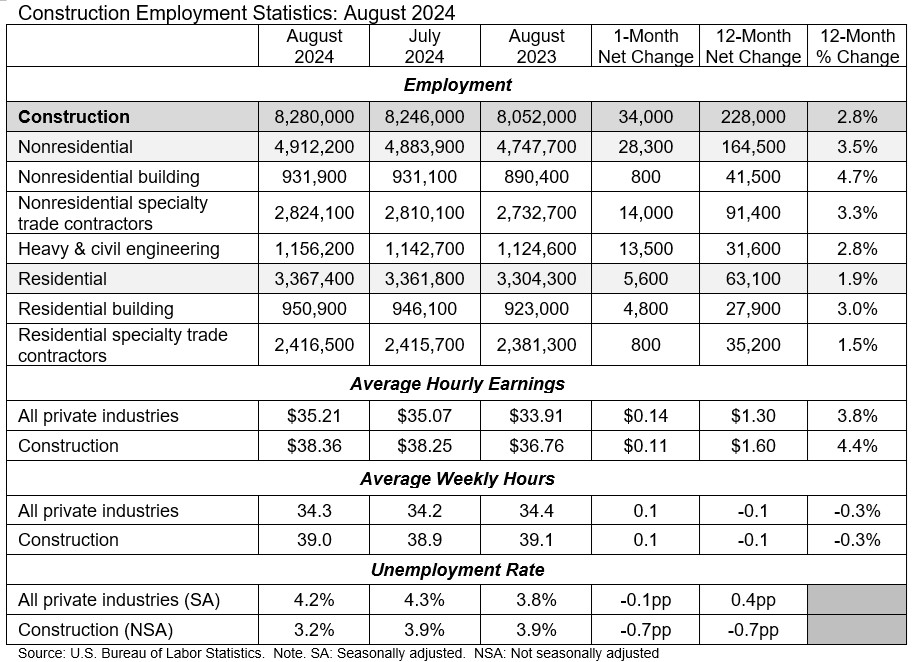

Construction employment in August totaled 8,280,000, seasonally adjusted, an increase of 34,000 from July. The sector has added 228,000 jobs or 2.8% during the past 12 months, nearly double the 1.5% increase for total nonfarm employment.

“Construction job growth was the strongest in five months in August,” said Ken Simonson, the Associated General Contractors of America chief economist.

Average hourly earnings for production and nonsupervisory employees in construction—covering most onsite craft workers as well as many office workers climbed by 3.8% over the year to $35.81 per hour. Overall private sector pay for production workers rose 4.1%, to $30.27. That difference in hourly pay constituted a wage “premium” of just over 18% compared to the overall private sector.

Per the federal data, all types of construction firms added employees in August.

Nonresidential construction firms added 28,300 employees, including 800 at building firms, 14,000 at specialty trade contractors, and 13,500 at heavy and civil engineering construction firms.

Employment at residential firms rose by 5,600, including 4,800 at builders and 800 at specialty trade contractors. This aligns with the six-month moving average of 5,667 jobs a month.

Data analysis showed that residential construction employment now stands at approximately 3.4 million in August. This includes 951,000 builders and 2.4 million residential specialty trade contractors.

“The record-low unemployment rate for jobseekers with construction experience shows how much difficulty contractors face in finding qualified workers,” Simonson said.

The industry’s unemployment rate fell to 3.2%, the lowest August rate in the 25-year history of the federal data being collected and analyzed. Comparatively, unemployment across all industries declined from 4.3% in July to 4.2% last month.

The industry’s unemployment rate fell to 3.2%, the lowest August rate in the 25-year history of the federal data being collected and analyzed. Comparatively, unemployment across all industries declined from 4.3% in July to 4.2% last month.

Associated Builders and Contractors Chief Economist Anirban Basu suggests the August employment report is consistent with the notion of a “soft landing” in reference to interest rates and the Federal Reserve.

“Unemployment fell both economywide and in the nation’s construction sector. Job growth in nonresidential construction was both brisk and broad-based,” he said. “Moreover, Federal Reserve officials continue to indicate that they are ready to reduce interest rates, which is expected next week.”

Despite the apparent relief coming on interest rates, Basu said there remains a level of concern among contractors according to ABC’s Construction Confidence Index and Construction Backlog Indicator.

Many projects have been postponed recently in the context of still-elevated borrowing costs and tighter lending conditions.

“Despite indications that interest rates are coming down, they may not fall as rapidly as many contractors hope,” Basu said. “The economy remains too strong to warrant rapid declines in interest rates implemented by the Federal Reserve. Moreover, average hourly earnings expanded more rapidly in August than anticipated, suggesting that inflation remains sticky and that Fed officials may only be able to reduce rates gingerly.”