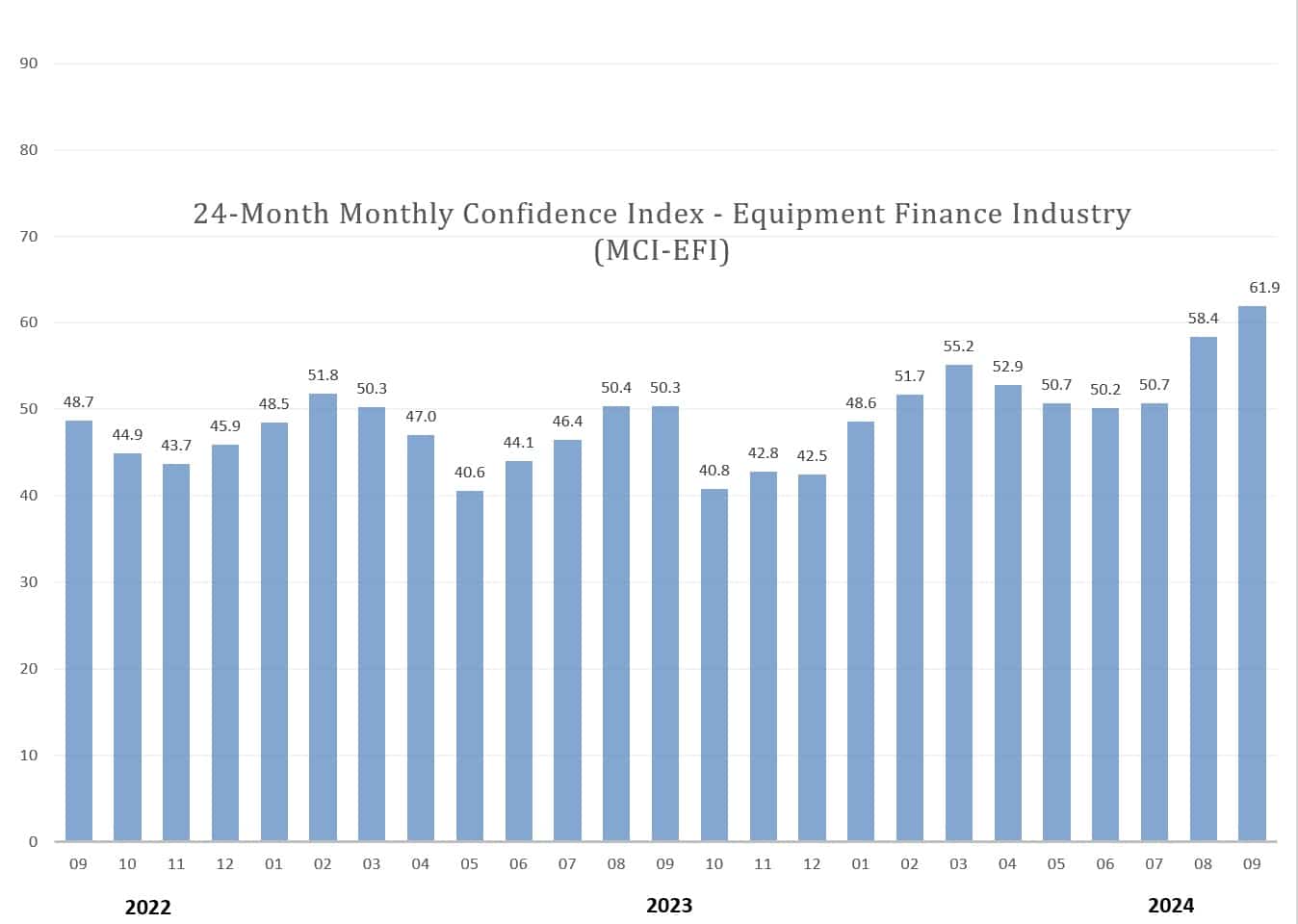

Equipment Finance Confidence Rising

Confidence in the equipment finance market is reportedly on the rise according to the Equipment Leasing & Finance Foundation.

Last week, the foundatin released the September 2024 Monthly Confidence Index for the Equipment Finance Industry. The September score of 61.9 was up from the August index of 58.4 and the highest since January 2022.

Last week, the foundatin released the September 2024 Monthly Confidence Index for the Equipment Finance Industry. The September score of 61.9 was up from the August index of 58.4 and the highest since January 2022.

The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector.

“Many firms, particularly small and medium-sized businesses, have been delaying equipment purchases, citing continued high interest rates and uncertainty about the economy amplified by the upcoming election,” said Nancy Pistorio, president, Madison Capital. “This ‘let’s wait and see what happens’ mindset has contributed to diminished demand for equipment financing.”

On Sept. 18, the Federal Reserve cut rates by a half a point, the first reduction since March 2020.

Pistorio and others seems to agree that a continued rate decline and barring any adverse impact to the financial markets based on the election results, the end of 2024 and Q1 2025 should be more robust.

“There is still concern of the risk that the Fed will not be able to guide to a soft landing and inflation will remain sticky. Consumer debt and U.S. debt levels are unsustainable,” noted Mark Bonanno, president and COO, North Mill Equipment Finance.

David Normandin, president and CEO, Wintrust Specialty Finance added that while there are many examples of uncertainty to point to today, he has found that businesses are adapting and finding ways to win, and it is an opportunity for the industry to adapt and grow with them.

“Even with solid liquidity, delinquency and portfolio performance are challenging for many, so credit discipline is required more now than over the last few years,” he said.

September 2024 Survey Results

Based on the overall index report, the outlook looks positive heading into Q4 2024 and the Q1 2025. Following is a summary of the survey results:

- When asked to assess their business conditions over the next four months, 40% of the executives responding said they believe business conditions will improve over the next four months, an increase from 37.5% in August. 52% believe business conditions will remain the same over the next four months, up from 45.8% the previous month. 8% believe business conditions will worsen, down from 16.7% in August.

- 44% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, up from 41.7% in August. 52% believe demand will “remain the same” during the same four-month time period, up from 37.5% the previous month. 4% believe demand will decline, a drop from 20.8% in August.

- 24% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, up from 20.8% in August. 76% of executives indicate they expect the “same” access to capital to fund business, up from 75% last month. None expect “less” access to capital, down from 4.2% the previous month.

- When asked, 20% of the executives report they expect to hire more employees over the next four months, a slight decrease from 20.8% in August. 68% expect no change in headcount over the next four months, down from 70% last month. 12% expect to hire fewer employees, up from 8.3% in August.

- None of the leadership evaluate the current U.S. economy as “excellent,” unchanged from the previous month. 96% evaluate the economy as “fair,” up from 91.7% in August, while 4% evaluate it as “poor,” down from 8.3% last month.

- 24% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, down from 37.5% in August. 76% indicate they believe the U.S. economy will “stay the same” over the next six months, a jump up from 41.7% last month. None believe economic conditions in the U.S. will worsen over the next six months, a decrease from 20.8% the previous month.

- In September, 36% of respondents indicated they believe their company will increase spending on business development activities during the next six months, an increase from 33.3% the previous month. 56% believe there will be “no change” in business development spending, down from 62.5% in August. 8% believe there will be a decrease in spending, up from 4.2% last month.