Contractor Confidence Drops in July, ABC Says

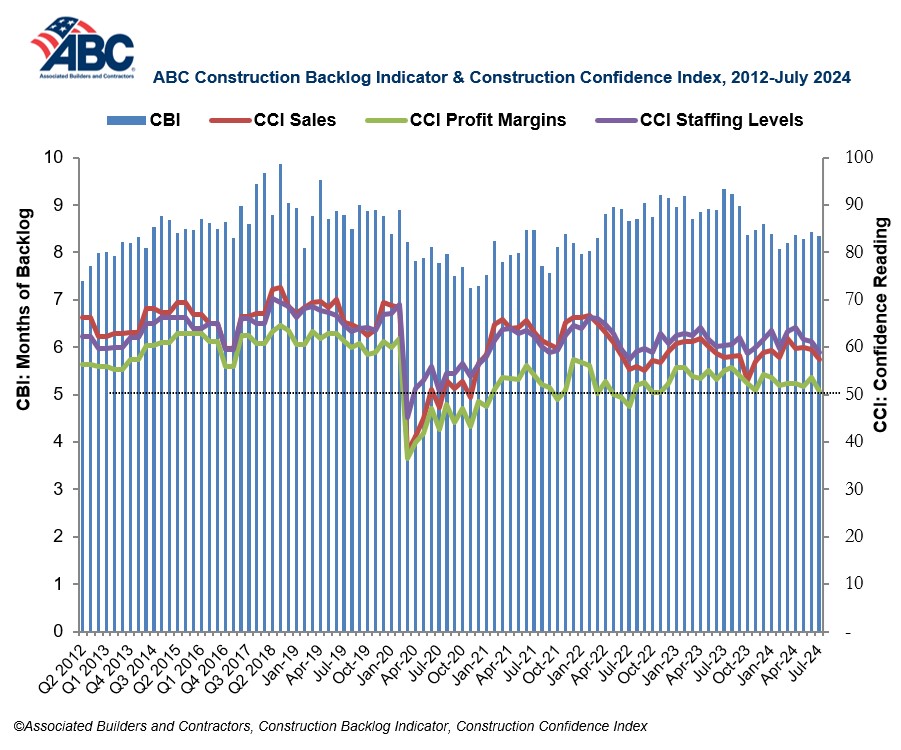

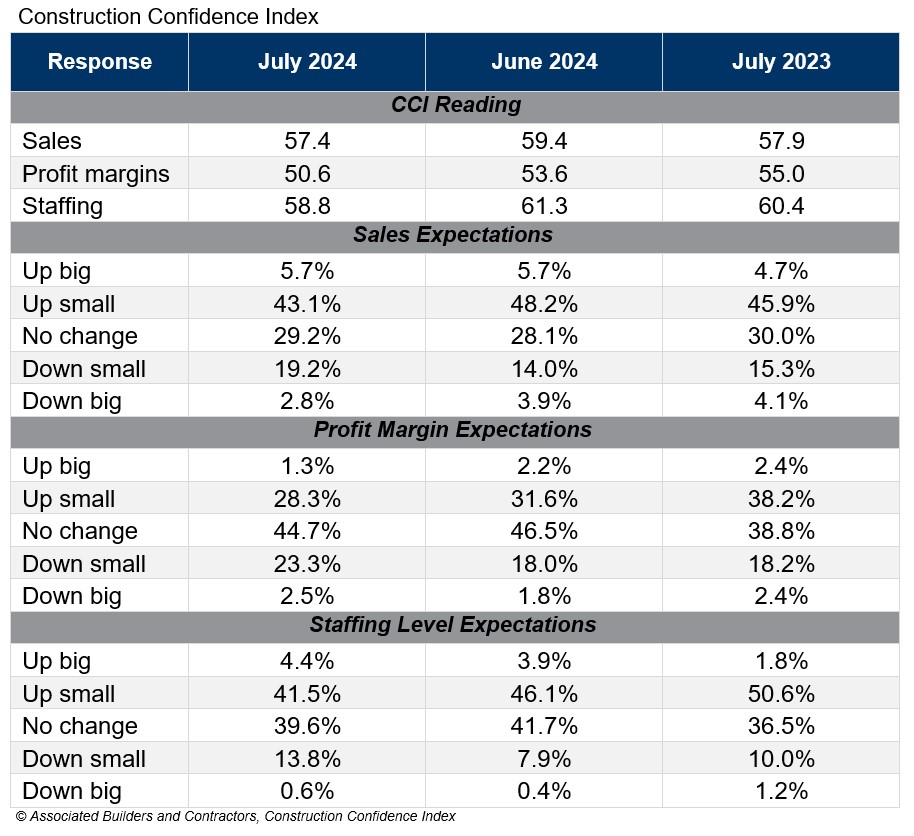

Confidence among construction contractors about sales, profit margins, and staffing levels is at its lowest levels since November 2022 according to surveys taken by the Associated Builders and Contractors.

|

|

|

“There are now strong indications that elevated interest rates have finally taken their toll on a number of privately financed construction segments as well as the broader economy,” said ABC chief economist Anirban Basu. "While inflation has moderated in recent months, construction materials prices remain almost 40% above pre-pandemic levels."

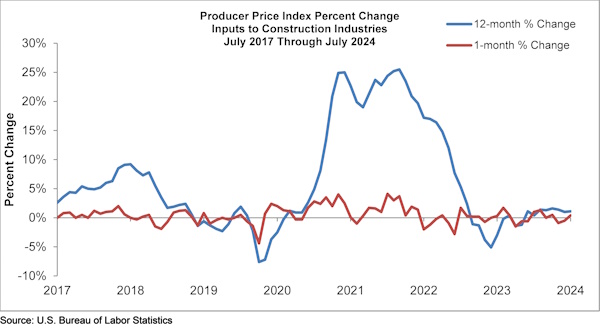

Construction input prices increased 0.4% in July compared to the previous month, according to ABC’s analysis of U.S. Bureau of Labor Statistics Producer Price Index data. Nonresidential construction input prices also increased 0.4% for the month.

Overall construction input prices are 1.1% higher than a year ago, while nonresidential construction input prices are 0.8% higher.

In addition, prices increased in all three energy subcategories last month. Natural gas prices were up by 13.3%, while unprocessed energy materials and crude petroleum prices rose 6.2% and 5.5%, respectively.

“Construction input prices increased in July, ending a streak of two consecutive monthly declines,” Basu said. “Despite the monthly uptick, which was largely driven by higher petroleum and natural gas prices, input prices are up just 1.1% year over year.”

He noted that the lack of materials price escalation over the past 12 months is a welcome development for contractors, just 34% of whom expect their profit margins to expand over the next six months, according to ABC’s Construction Confidence Index.

|

|

|

“Ongoing input price moderation, along with the prospect of lower interest rates by the end of the third quarter, should bolster contractor sentiment in the coming months,” Basu said. “With construction spending down for the past two months, the industry eagerly awaits lower interest rates. Given recent economic turmoil, the Federal Reserve will begin cutting rates at its September meeting.”

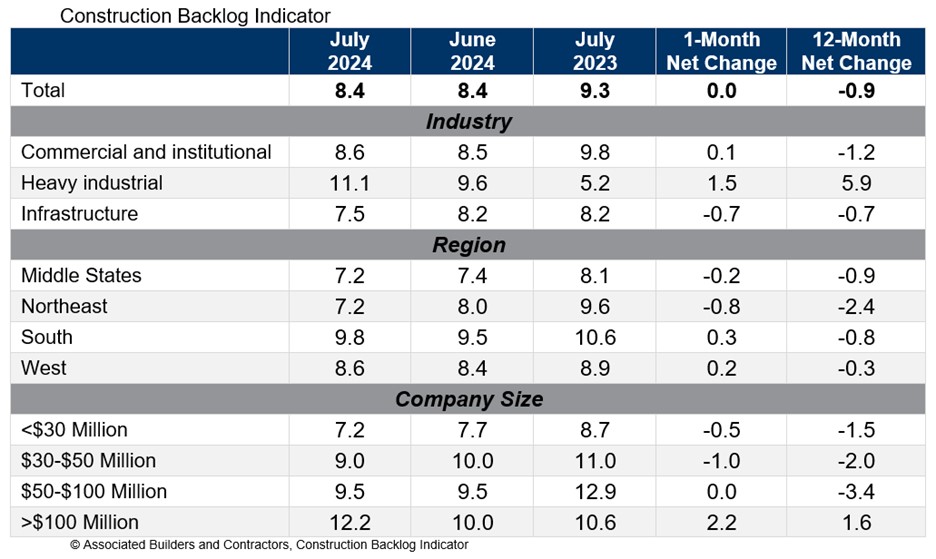

Meanwhile, ABC’s Construction Backlog Indicator held steady at 8.4 months in July, according to an ABC member survey conducted July 22 to Aug. 6. The reading is down 0.9 months from July 2023.

Only the largest contractors, those with greater than $100 million in annual revenues, have a longer backlog than one year ago. On a monthly basis, the decline in backlog was driven by declines among the smallest contractors, those with less than $50 million in annual revenue.