Construction Spending Dips 0.3% in July

Construction spending slid 0.3% from June to July, pulled down by declines in private residential and nonresidential construction according to an Associated Builders and Contractors and Associated General Contractors of America analysis of data published by the U.S. Census Bureau.

“Nearly all spending categories show increases from a year ago but have fluctuated in recent months,” said Ken Simonson, AGC’s chief economist.

Construction spending, not adjusted for inflation, totaled $2.162 trillion at a seasonally adjusted annual rate in July.

That figure is 0.3% below the June rate, but 6.7% above the July 2023 level. The May and June estimates were revised up, showing that spending was flat in June rather than declining, as initially reported.

“While Hurricane Beryl, which interrupted construction activity along the Gulf Coast in early July, contributed to the month’s weak construction spending data, the cumulative effect of high interest rates likely bears more blame,” said ABC Chief Economist Anirban Basu.

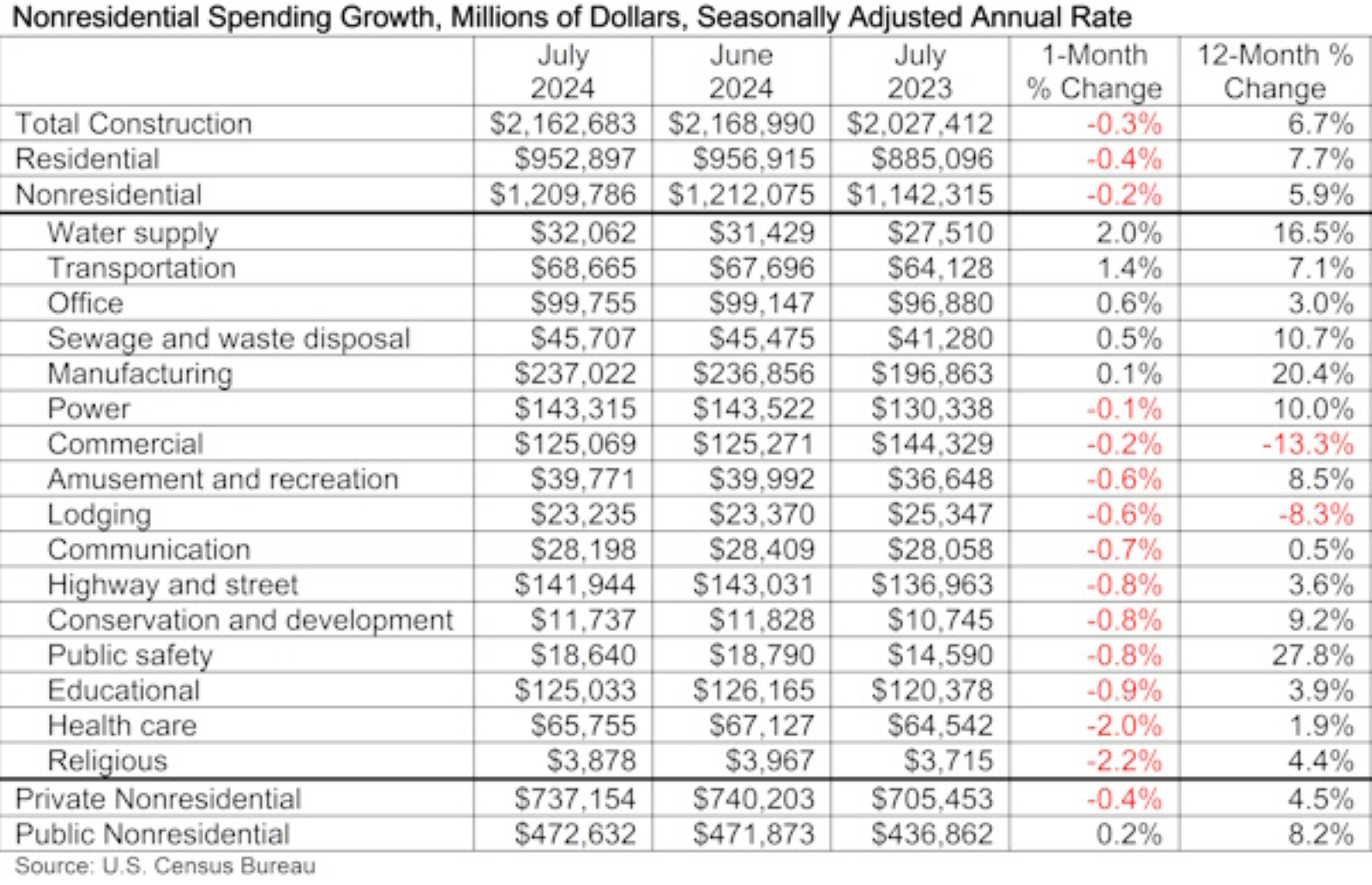

Analysis showed that national nonresidential construction spending decreased 0.2% in July. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.21 trillion.

Spending was down monthly in 11 of the 16 nonresidential subcategories.

Private nonresidential and residential spending both fell 0.4% in July but rose year-over-year, by 7.7% and 4.5%, respectively. Public construction spending climbed 0.1% for the month and 8.1% from July 2023.

“Nonresidential construction spending declined for the second consecutive month in July but remains just 0.4% below the all-time high established in May,” Basu said.

Both organizations have found that worker shortages have played a role in the spending reduction.

According to Simonson, the recent 2024 AGC/Arcoro workforce survey suggests that part of the spending issue is the continued shortage of qualified workers.

AGC says 54% of respondents have experienced delays due to worker shortages.

Results found that 94% of respondents that have openings for hourly craft workers are having difficulty filling the positions. Similarly, 92% indicated difficulty in filling salaried positions. The totals for both questions were an increase of 6% over last year’s numbers.

“Less than half of contractors expect their sales to increase over the next six months,” Basu said, citing ABC’s Construction Confidence Index.

He believes that is an indication that the industry is awaiting a reduction in interest rates.

“Fortunately, it’s all but certain that the Federal Reserve will begin lowering rates at its September meeting. The remaining question is whether it will be a 25- or 50-basis point cut.," Basu said.