ELFF Forecasts 4.4% Rise in Q4 Equipment Investment

Real equipment and software investment growth is projected to be 4.4% in 2024 according to the Q4 update to the 2024 Equipment Leasing & Finance Foundation U.S. Economic Outlook.

|

|

The foundation says the U.S. economy remains on strong footing, fueled in part by continued healthy investment in equipment and software, with a modest near-term outlook for investment growth and the potential for improvement next year as interest rate cuts start to take effect.

The Equipment Leasing & Finance U.S. Economic Outlook report is produced by the foundation in partnership with economic and public policy consulting firm Keybridge Research.

It provides the U.S. macroeconomic outlook, credit market conditions, and key economic indicators focused on the $1.16 trillion equipment leasing and finance industry and highlighting key trends in equipment investment, placing them in the context of the broader U.S. economic climate.

The Q4 report is the third update to the 2024 Economic Outlook, and will be followed by the publication of the 2025 Economic Outlook in December.

In addition to the anticipated projected increase in equipment investment growth, it forecasts real GDP growth of 2.7% this year, a slight uptick from the foundation’s Q3 update to the 2024 Economic Outlook published in July.

“The Foundation’s Q4 Outlook continues to support a soft-landing scenario and provides optimism for 2025 investment activity,” said Leigh Lytle, president of the foundation, and president & CEO of the Equipment Leasing and Finance Association.

Per the Q4 report, equipment and software investment bounced back in Q2 after three consecutive weak quarters, expanding by a strong 7.0% (annualized). Aircraft investment was primarily responsible for the improvement, along with information processing equipment, while industrial equipment contracted modestly.

Overall, the U.S. economy experienced broad-based growth in the second quarter, expanding at a 3.0% annualized rate (up from 1.6% in Q1).

Also, the analysis indicates that there was softer-than-anticipated job growth. Rising unemployment over the summer raised questions about the long-term sustainability of the current economic expansion. However, according to the report, layoffs remain low by historical standards while real wage growth is healthy.

The foundation says inflation is modestly elevated but largely contained, and the prospect for additional rate cuts later this year and next year should provide a boost to hiring and investment, making the economy appearing to be poised for growth in the new year.

“The U.S. economy has been impressively resilient but heightened political and economic uncertainty, as well as weather-related business interruptions, are likely to slow investment growth in Q4,” Lytle said.

She said the ELFA is optimistic that activity will remain strong in 2025 as Fed rate cuts start taking effect and election-related uncertainty abates.

In addition, Lytle noted that the Monthly Confidence Index for the Equipment Finance Industry agrees with Q4 Outlook findings, holding steady in October at its highest level since 2022.

Additional highlights from the Q4 update to the 2024 Outlook include:

- The manufacturing sector continues to struggle. Both shipments and new orders of core capital goods are sluggish, industrial production is soft, the ISM Purchasing Managers Index for Manufacturing has contracted for 22 out of the last 23 months, and manufacturing employment has fallen by 50,000 workers in 2024 (including 34,000 in the last two months).

- Small business owners have adopted a more cautious posture despite generally favorable business conditions. Recent shifts in the labor market, rising geopolitical tension, and the 2024 election have led to a rapid rise in uncertainty that may depress investment activity in the near term. At the same time, if inflation remains in check and the Fed gradually cuts rates as expected, activity should pick up again in early 2025.

- The Fed is characterizing its decision to cut rates by 50 bps rather than 25 bps as a “recalibration” rather than an emergency reaction to a weakening labor market. The Fed maintains that rate cuts are not intrinsically linked to a looming recession, but rather that a controlled easing of monetary policy, if properly timed and calibrated, can help keep the economy on track.

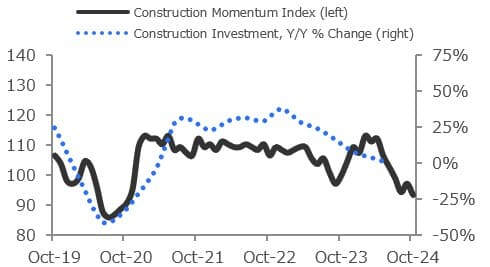

The Foundation-Keybridge U.S. Equipment & Software Investment Momentum Monitor, which is released in conjunction with the Economic Outlook, tracks 12 equipment and software investment verticals. In addition, the Momentum Monitor Sector Matrix provides a customized data visualization of current values of each of the 12 verticals based on recent momentum and historical strength. This month two verticals are expanding, two are peaking, four are recovering, and four are weakening. Over the next three to six months the foundation expects the following trends to materialize on a year-over-year basis:

- Agriculture machinery investment growth will continue to weaken.

- Construction machinery investment growth will continue to contract.

- Materials handling equipment investment growth may improve modestly.

- All other industrial equipment investment growth will remain muted, though recent movement is encouraging

- Medical equipment investment growth may expand modestly, but momentum is soft.

- Mining and oilfield machinery investment growth will remain weak, though recent movement is encouraging.

- Aircraft investment growth should continue to improve.

- Ships and boats investment growth appears to have bottomed out and should improve.

- Railroad equipment investment growth should remain positive, though momentum is slowing.

- Trucks investment growth will remain soft and may turn negative.

- Computers investment growth should continue to expand at a robust pace.

- Software investment growth will expand at a solid pace.