Contractors Brace for Tariff Impact on Material Prices

A surge in demand due to potential tariffs is among the factors that pushed construction input prices higher in January. Economists suggest prices could continue to rise.

|

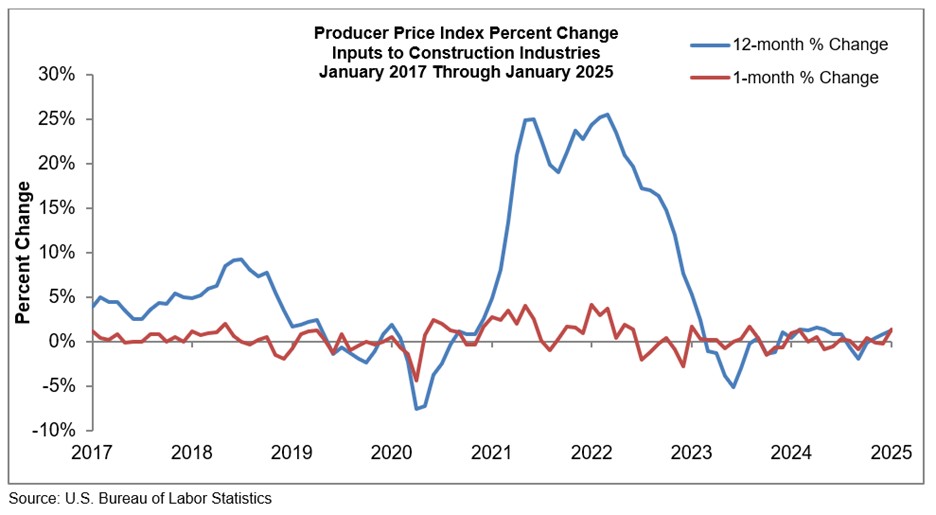

Analysis of the U.S. Bureau of Labor Statistics Producer Price Index by the Associated Builders and Contractors indicated that input prices rose 1.4% in January compared to the previous month.

Nonresidential construction input prices increased approximately 0.9% from December to January, the largest increase in costs in the past 12 months, according to an analysis of the data by the Associated General Contractors of America.

The producer price index for new nonresidential construction, a measure of what contractors report they would charge to put up a specific set of buildings, climbed 0.3% in January and 1.7% over the past 12 months.

The cost of cement rose by 3.2% in January year-over-year, while ready-mixed concrete increased by 4.1% compared to a year ago. Asphalt paving mixtures saw a significant 8.6% rise. On the metals side, aluminum mill shapes climbed 9.7% for the year, and copper and brass mill shapes surged 12.3% during the past twelve months, each being critical components in electrical and plumbing applications.

On a year-over-year analysis, construction input prices are 1.3% higher than a year ago, while non-residential construction input prices are 0.7% higher. Based on ABC’s review of the data, material prices have increased 40.5% since February 2020.

“Materials prices increased at the fastest monthly pace in two years in January,” said Anirban Basu, ABC chief economist. “This rapid escalation is largely due to three factors. First, energy prices rose sharply. Second, producers often raise their prices at the start of the year. And third, many purchasers rushed to buy inputs before potential tariffs could go into effect, and that surge in demand pushed prices higher.”

The data indicates that prices increased in all three energy subcategories last month. Crude petroleum prices increased 14.8%, while natural gas and unprocessed energy material prices increased 13.7% and 13.0%, respectively.

However, Basu noted that of the three primary factors, tariffs are the only ones that could continue to push input prices higher in the coming months. Basu and his AGC counterparts, have cautioned that materials costs, particularly for steel and aluminum products, are likely to continue increasing now that the Trump administration has imposed a 25% tariff on those products. The cost increases will extend to the overall price of the construction projects, potentially leading to delays or cancellations.

“The math is pretty simple, the more contractors have to pay for the materials they need, the more it will cost to build new infrastructure, housing and economic development projects,” said Jeffrey Shoaf, the chief executive officer of the AGC. “As much as want to see new domestic manufacturing capacity, stifling construction activity is clearly not the best way to help.”

Basu said import taxes allow domestic producers to raise their prices, and the new 25% levies on steel and aluminum will result in just that if they remain in place. In addition, he pointed out that according to ABC’s Construction Confidence Index, a majority of contractors are expecting an increase in sales over the next six months.

“The combination of increased demand for construction inputs and ongoing supply chain confusion suggests input price escalation could accelerate through the first half of 2025,” Basu said.