Construction Sector Adds 4,000 Jobs in May

Construction sector employment increased by 4,000 positions in May according to analysis of the latest government data by both the Associated Builders and Contractors and Associated General Contractors of America.

|

Rising wages enabled the industry to add workers more rapidly than other sectors.

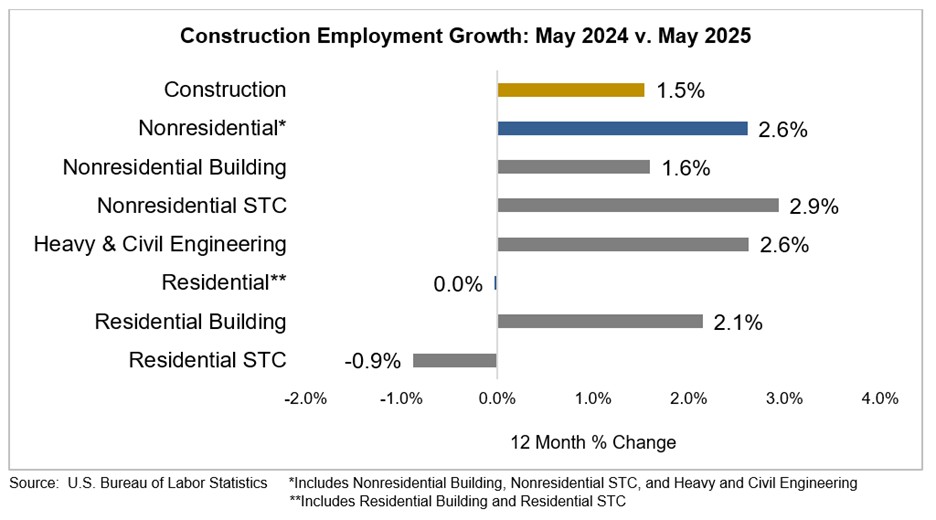

Construction employment in May totaled 8,314,000, seasonally adjusted. On a year-over-year basis, industry employment has increased by 126,000 jobs, an increase of 1.5%, topping the 1.1% growth rate in total nonfarm payroll employment.

However, the sector’s rate of growth was markedly slower than the 2.8% increase in construction employment recorded a year earlier. Association officials suggested that the slow down could be related to the recent market uncertainty.

Nonresidential construction firms added 11,300 workers in May, including 4,500 among specialty trade contractors, 3,100 in nonresidential building construction, and 3,700 in heavy and civil engineering construction.

“Nonresidential construction firms added employees in May for the 13th month in a row,” said Ken Simonson, AGC’s chief economist. “However, constant changes in tariffs and other policies that are affecting the cost and demand for construction have led to a significant slowdown in hiring.”

Residential construction employment offset those gains, declining by 7,400 jobs, as residential specialty trade contractors lost 11,000 positions while homebuilders and other residential building construction firms added 3,600 workers.

ABC Chief Economist Anirban Basu noted that the increase within the nonresidential segment was offset by a softness in the residential segment, which lost more than 7,000 jobs in May.

“Even so, the industrywide unemployment rate fell to an exceptionally low 3.5% in May, indicating that the labor supply remains unusually tight,” Basu said. “Despite healthy nonresidential hiring, the broader industry has added just 25,000 jobs from January to May.”

He said that it is the slowest five-month employment growth since 2020, indicating that high interest rates, tight lending standards and policy uncertainty are impacting industry momentum.

The 3.5% unemployment rate in May is down from 3.9 percent a year earlier. A separate government report showed the construction job openings rate declined to 2.9% in April, the lowest since 2020. The hiring rate reportedly rose to 4.2%, while the layoff rate rose slightly to 2.1%.

Simonson said the data suggests that contractors are holding onto existing workers even as they scale back on new hiring.

Average hourly earnings for production and nonsupervisory employees in construction, including most onsite craft workers and many office staff, increased 4.7% percent over the year to $37.13. That gain exceeded the 4% rise in pay for such workers in the private sector.

“Construction firms continue to hire and boost wages, but the pace of growth has slowed as demand for certain types of projects cools,” said Jeffrey D. Shoaf, AGC’s chief executive officer. “As federal officials provide more certainty about tariffs, taxes and investment levels, demand for projects is likely to rebound.”

Meanwhile, ABC’s Construction Backlog Indicator fell to 8.4 months in May, up 0.1 months since May 2024. Conversely, per the association’s Construction Confidence Index, contractors remain broadly optimistic.

“The impacts of tariffs are increasingly apparent, with nearly 1 in 4 ABC member contractors reporting tariff-related project cancellations or delays in May,” Basu said. “While 87% of survey respondents have been notified of tariff-related materials price increases, profit margin expectations actually improved in May.”

He said that while the survey was conducted prior to the now implemented 50% steel and aluminum tariffs, and margins will likely come under pressure in the coming months, approximately 6 out of 10 contractors expect their sales to increase over the next two quarters, suggesting widespread optimism.