Nonresidential Construction Adds 28,800 Jobs in November

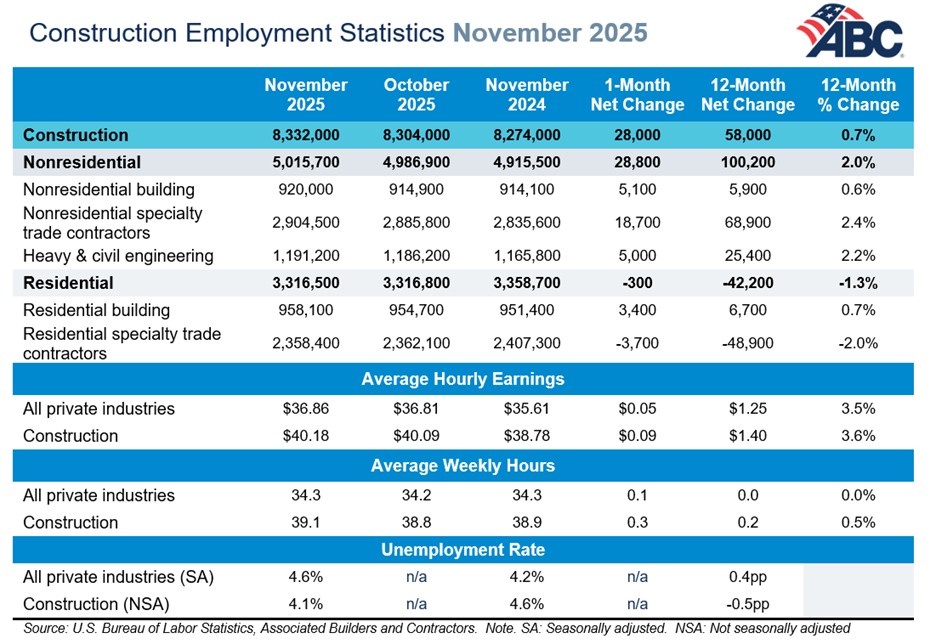

Analysis of data released by the U.S. Bureau of Labor Statistics shows that the construction industry added 28,000 jobs in November.

|

The Associated Builders and Contractors review of the data indicates that on a year-over-year basis, industry employment increased by 58,000 jobs, a 0.7% increase.

Nonresidential construction employment increased by 28,800 positions, with gains in all three sub-categories.

Specialty trades added 18,700 jobs, while nonresidential building and heavy and civil engineering added 5,100 and 5,000 jobs, respectively.

The construction unemployment rate was 4.1% in November. Unemployment across all industries rose to 4.6% and is 0.4 percentage points higher than one year ago.

“Construction industry job growth has picked up over the past three months,” said Anirban Basu, ABC chief economist.

The industry has added 52,000 jobs since August, a stark reversal from the 9,000 jobs lost during the first eight months of the year.

“This recent rebound has been led by rapid growth in nonresidential specialty trade contractor employment, a trend that is at least partially due to the surging need for electricians caused by the data center construction boom,” Basu said.

In conjunction with the jobs report, Basu noted that ABC’s Construction Backlog Indicator is down on both a monthly and yearly basis for every size of contractor other than those with greater than $100 million in annual revenues.

“Backlog declined sharply in November and is now at the lowest level since February 2024,” Basu said. “The decline was particularly steep for the smallest contractors; ABC members with under $30 million in annual revenues registered their lowest backlog reading in over four years.”

Notably, he said fewer than 6% of those smallest contractors are under contract to work on data center projects, well below the 37% share for contractors with greater than $100 million in annual revenues.

Basu said ABC’s Construction Confidence Index reading for sales increased in November, while the readings for profit margins and staffing levels declined. The readings for all three components remain above the threshold of 50, indicating expectations for growth over the next six months.

“Despite the decline in backlog, contractors remain broadly optimistic that their sales and staffing levels will expand over the next six months,” Basu said. “At the same time, just 33.6% of contractors expect their profit margins to expand over the next two quarters, the lowest share in over a year. That likely reflects growing anxiety about materials costs, which have started to rise after several quarters of relative stability.”