|

Sure, any disc or wheel will work for awhile, but the professional users demand professional results from their abrasive products. As manufacturers in different industries are using higher grade metals for production, higher-quality abrasive grains are needed to create that finished look. These companies are among the leaders in the field with products that continue to advance the art and science of cutting, grinding, and polishing.

UNITED ABRASIVES/SAIT

|

| For United Abrasives/SAIT and other manufacturers, it is the efficiency and cost savings of ceramic abrasives that will continue to play a greater role in shaping the industry in 2025. |

At United Abrasives/SAIT, ceramic abrasives are expected to play a pivotal role in shaping the future of manufacturing, metalworking, and finishing industries in 2025.

“The global shift toward advanced manufacturing technologies, automation, and precision engineering is driving the adoption of ceramic abrasives,” says Leo Lavigne, director of product management and regional sales at United Abrasives. “As industries continue to prioritize efficiency, quality, and sustainability, ceramic abrasives will remain a key tool in meeting these demands.”

Ceramic abrasives are a high performance, man-made abrasive material which have a very uniform, high density grain structure and are extremely durable and self-sharpening for a longer life and cooler cut.

According Lavigne, it is those factors, as well as the increased efficiency and cost savings that have led to the poplularity of ceramic abrasives.

He says they excel on tough to grind materials.

“Ceramic technology is evolving and improving, allowing them to excel in applications where other abrasives fail,” he says. “These advanced materials have been gaining significant traction in recent years and their role is poised to expand even further in the coming decade.”

Lavinge says United Abrasives/ SAIT offers many coated ceramic abrasives products including flap discs, fiber discs, belts, and paper discs.

“All of our products (including our ceramics) are made to perform to the highest standards, supported by superior service and support,” he says.

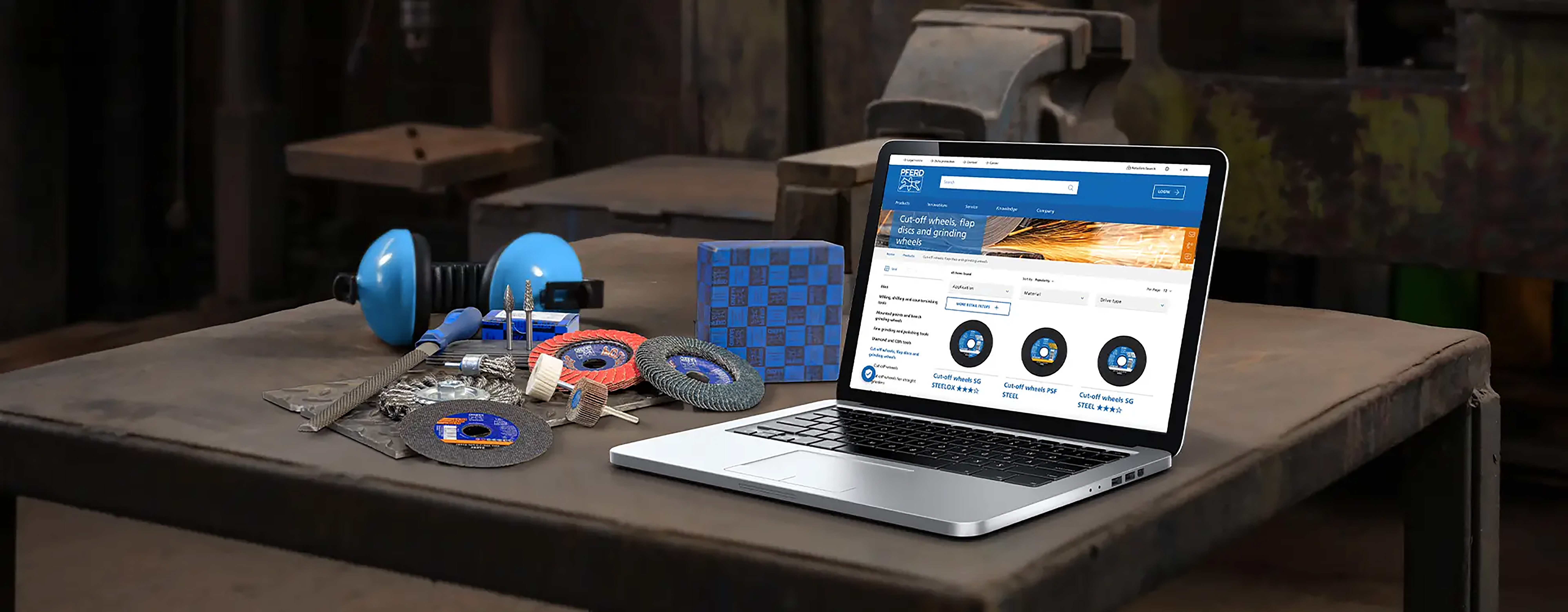

PFERD

The anticipation from PFERD North America is that 2025 will be a year of strategic transformation for the industry, with technology playing a central role.

Rafael Astacio, president of PFERD North America states that although geopolitical and economic conditions may slow down some expansion efforts, the customer’s demand for seamless digital experiences and efficient product and service delivery is only expected to grow.

“Many companies are pursuing acquisitions to broaden their geographic reach and become full-service providers for their customers,” he says, adding that rapid growth presents challenges in maintaining quality, consistency, and a solid and sustainable operational foundation.

“E-commerce technology will remain a significant focus area as organizations recognize that investing in a robust and flexible digital platform is essential for future growth,” Astacio says. “Companies that successfully integrate digital tools with customer needs will lead the way in 2025.”

|

| PFERD North America believes that technology, e-commerce and further digital transformation will be at the forefront of the growth of the abrasives and industry growth in 2025. |

For Astacio, the most significant trend in the B2B and B2C industry today is the focus on e-commerce and digital transformation, rather than solely the issues of company size or market economics.

With younger, data-savvy leaders taking on decision-making roles, the demand for digital innovation and easy access to information is likely to continue accelerating. Already, Astacio says today’s customers expect efficient tools that streamline processes, boost productivity, and provide a seamless supply chain experience.

Two main factors driving these trends are optimization of inventory management and the broader digital transformation, which includes automation and artificial intelligence (AI).

“Supply chain and inventory management are fundamental to industrial distribution, yet they are incredibly complex to manage effectively,” he says. “AI and digital technologies are increasingly recognized as solutions to these challenges, enabling companies to automate routine tasks, enhance accuracy, and manage larger volumes of work with speed and precision.”

In addition, the role of robotics is also expanding, with collaborative robots (co-bots) expected to bring significant efficiencies.

Astacio says the push for advanced automation is reaching a tipping point, and PFERD anticipates rapid advancements in this area for the industry.

In the long term, Astacio feels the focus will shift towards customer retention and personalized service as the industry navigates data management challenges.

“Companies that can effectively track, analyze, and utilize data from every touchpoint such as orders, contracts, communications, customer evolving needs, interactions, and more, will gain a significant advantage in delivering unique tailored customer experiences,” he says. “Additionally, having a strong omnichannel sales strategy will be essential for engaging customers in both online and offline environments. As digital and physical channels blend, companies with robust, integrated strategies and clear, concise execution plans, will excel by providing personalized and seamless experiences that encourage loyalty and foster long-term customer relationships.”

Meanwhile, PFERD continues to add to its line. This year, PFERD acquired a majority stake in Silmax, an Italian manufacturer of milling and drilling tools for the metalworking industry.

“This strategic investment marks a significant milestone for our company, demonstrating our commitment to expanding into new product categories to meet and exceed our customers’ needs,” Astacio says. “It emphasizes our focus on success and future growth.”

|

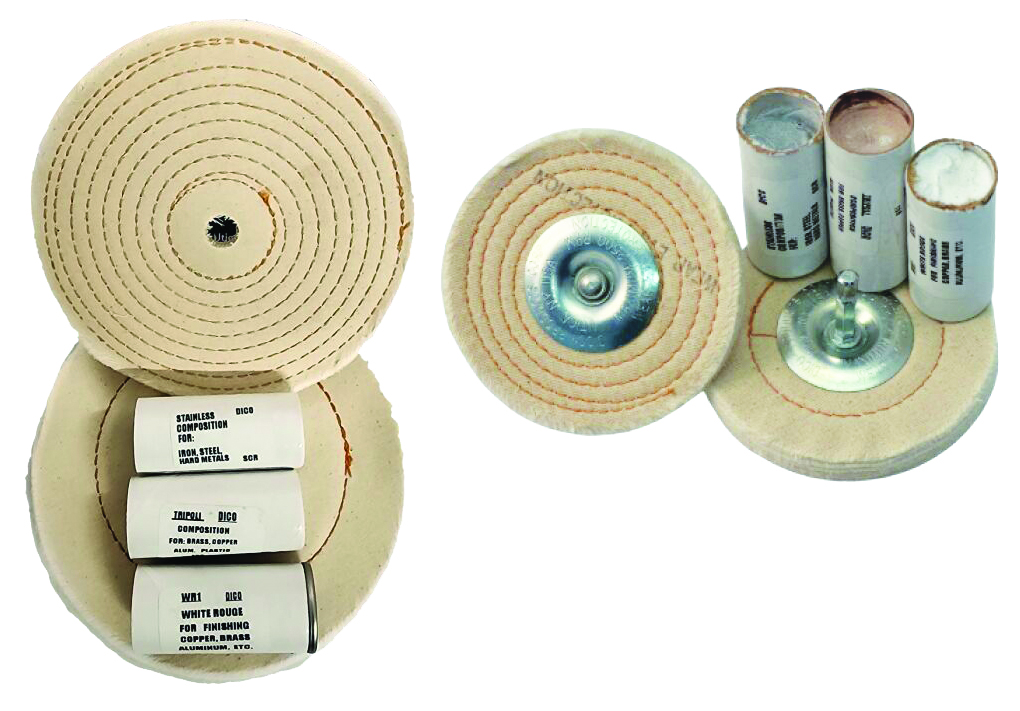

| More new products are on the horizon for the familiy-owned and operated Dico Products in 2025. |

DICO PRODUCTS

New products are expected from family-owned and operated Dico Products in 2025.

Sales manager Rich Amann says the next generation of the company is starting to weave historical products into better web designs integrated with social media presence.

He is cautiously optimistic about 2025, pending any implementation of tariffs and the continuation of the trend of mergers and buyouts of both distributors and manufacturers.

GEMTEX ABRASIVES

The abrasive industry is constantly striving to improve efficiencies in the metal finishing category. Frank Prenda, vice president sales and marketing at Gemtex notes that surface conditioning products are part of an ever-expanding category of non-woven abrasives.

“These products, in various shapes and sizes, are used to blend, deburr and polish metals when specific surface finishes are required,” he says. “Due to the versatility of this category and requests from customers, Gemtex has added three high performance grades to expand its Brite-Prep surface conditioning line and help reduce the need to use coated abrasive products, which could possibly scratch or damage metal surfaces.”

Extra Coarse, Extra Coarse High Density and Medium High Density have been added for more aggressive cutting action and more rigidity within the surface conditioning category.

“When the objective is metal removal and to achieve desired finishes with the minimum number of steps, flap discs are the ideal products to achieve this goal,” Prenda says.

|

| When the objective is metal removal and to achieve desired finishes with the minimum number of steps, flap discs are ideal. Gemtex Abrasives will be unveiling new ceramic options in the fourth quarter of 2025. |

To meet these varied demands, Gemtex Abrasives has introduced an expanded offering of flap discs to address both ends of the quality and price spectrum. The product line, manufactured in the company’s Toronto factory, is composed of two brands designated by price and quality, Flaptex and Gemflex.

“Today, and as we move forward in the future, various grades of quality ceramic products will be needed on a much larger scale,” Prenda says. “Much like the start of the EV auto industry, it is a race to the top for companies to provide abrasive products with ‘affordable’ ceramic grain.”

Currently, the higher grades of ceramic grain available are very expensive, and in some cases, prohibitively priced even as many aerospace end users are manufacturing with higher grade metals such as Inconel, Hastelloy and titanium which require a high-quality abrasive grain.

“In response to the need for a high-quality ceramic grain in the marketplace, Gemtex has been working closely with our abrasive grain suppliers to assist in the research and development of an acceptable grade of ceramic grain,” Prenda says. “We then provide our lab testing results to compare with their findings to try and achieve the end grade quality to meet the standards to which end users deem acceptable at a competitive price.”

New ceramic grain options are on the horizon at Gemtex with a potential launch date in Q4 of 2025.

LEARN MORE

This article originally appeared in the December 2024/January 2025 issue of Contractor Supply magazine. Copyright, 2024/2025 Direct Business Media.